The U.S. Supply Chain Transformation: Reshoring, Nearshoring, And Friend Shoring For Resilience

From Just-in-Time Efficiency to Systemic Fragility

For decades, the dominant supply chain model relied on just-in-time production. Goods moved from Asian factories to US markets with minimal inventory and precise scheduling. The system reduced costs and boosted margins, but it assumed stable geopolitics, predictable transportation, and uninterrupted global trade.

What emerged was not a temporary disruption, but a structural failure. Firms and governments began to reassess supply chains as strategic assets rather than cost centers.

What Defines the US Supply Chain Transformation

Three approaches define this transition.

- Reshoring focuses on bringing manufacturing and critical supply chains back to the United States.

- Nearshoring shifts production to geographically close partners, primarily Mexico and Canada.

- Friend-shoring relocates supply chains to countries with strong political alignment, trade ties, and stable institutions.

Several forces made the old model unsustainable.

- Geopolitical Tensions and National Security: The US-China trade conflict highlighted the vulnerability of relying on a strategic competitor for semiconductors, rare earths, and pharmaceuticals (The New York Times, 2025). The war in Ukraine exposed the risk of relying on adversarial countries for resources.

- High Cost of Supply Chain Distribution: During the pandemic, delays and freight price spikes erased decades of cost savings from global sourcing. OECD data shows that logistical breakdowns outweighed efficiency gains, forcing businesses to reassess total supply chain cost rather than unit price alone.

- Push for Resilience: Companies began shifting toward just-in-case approaches by holding safety stock, adding backup suppliers, and diversifying production footprints. Predictability and shock absorption replaced marginal cost optimization.

- Government Legislation: Government policy accelerated the shift. The CHIPS and Science Act of 2022 provides over $52 billion to boost domestic semiconductor production. The Inflation Reduction Act of 2022 introduced tax credits for clean energy, electric vehicles, and battery production within North America.

- Consumer and Investors Demand: Consumer and investor expectations also evolved. Buyers and investors increasingly value supply chain ethics, sustainability, and reliability. Firms with visible, local, and resilient operations gained reputational and strategic advantages.

1. Reshoring and the Return of Domestic Manufacturing

Major chipmakers are leading the trend. Intel is expanding fabrication plants in Arizona and building a large-scale semiconductor hub in Ohio. TSMC is constructing a multi-fab campus in North Phoenix. Samsung is developing a major semiconductor complex in Texas that combines production and research.

2. Nearshoring: The “China +1” Strategy

Nearshoring is among the most popular and scalable supply chain strategies, with Mexico being the primary beneficiary (Boston Consulting Group, 2024). Companies are adopting a China +1 model. They maintain Asian production for global markets while shifting US-focused output to Mexico. This approach helps reduce risk without a complete exit from Asia.

Key Structural Advantages of Mexico:

- Proximity enables faster and cheaper truck and rail transport.

- The USMCA trade agreement provides tariff-free access and regulatory predictability.

- Shorter transit times reduce inventory risk and improve responsiveness.

3. Friend-Shoring and Trusted Supply Networks

Friend-shoring adds a geopolitical dimension to supply chain design. Production is relocated to countries with strong diplomatic ties, stable governance, and aligned economic interests (The World Economic Forum, 2023).

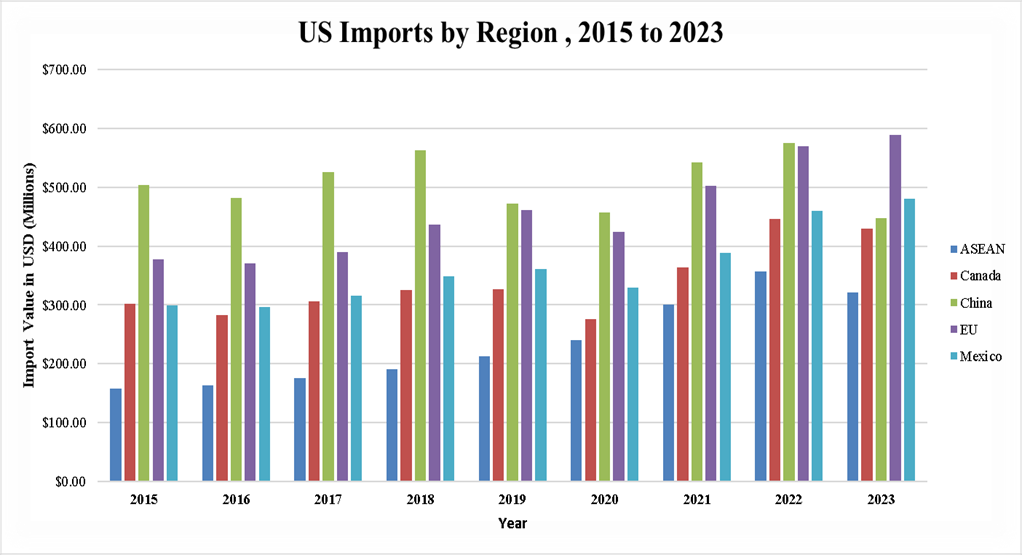

- China’s share of US imports peaked in 2018 at $563 billion but fell to $448 billion by 2023, reflecting efforts to reduce dependence on a single source.

- Mexico’s imports rose steadily from $299 billion in 2015 to $480 billion in 2023, highlighting its role as a nearshoring partner.

- Canada remains a stable supplier, with imports increasing from $302 billion in 2015 to $430 billion in 2023, peaking at $447 billion in 2022.

- ASEAN imports more than doubled, from $157 billion in 2015 to $321 billion in 2023, showing broader Southeast Asian sourcing.

- EU imports grew from $378 billion to $589 billion, reflecting continued reliance on advanced machinery, pharmaceuticals, and high-value goods.

The supply chain transformation depends on modern infrastructure and advanced technology. For companies to rebuild a more resilient system, they have to upgrade the tools and the networks that support it.

- Workforce Development: The new supply chain model depends on experts in logistics analysis, robotics, and advanced manufacturing. Investments in such areas help build a workforce that supports long-term growth.

- Digital Supply Chains: Companies are deploying AI to forecast demand and spot risks early, IoT sensors to track goods in real time, and cloud platforms to connect every stage of production and transport. This transition increases supply chain transparency and operational agility.

- Physical Infrastructure: The Bipartisan Infrastructure Law of 2021 allocates roughly $1.2 trillion between 2022 and 2026 to upgrade roads, rail, ports, and logistics corridors needed to handle increased domestic and regional freight.

With this shift, the growth of high-skilled, high-wage jobs in manufacturing will increase, and there will be reduced dependencies on adversaries for essential goods, strengthening national and economic security. Funding is flowing into regions that are building new factories, technology centers, and logistics hubs, creating momentum for industrial growth across the country.

Businesses

The shift brings lower long-term risk but higher upfront costs. Production costs in the US, Mexico, or allied countries are higher, yet they protect businesses from long delays and shutdowns. Businesses must build partnerships with suppliers in Mexico, the US, and allied countries. To stay competitive, they will have to invest in advanced technologies that provide visibility across the chain.

Consumers

Some products may cost more because of higher production costs, but with minimal shortages during crises and better availability trade-off. Consumers will have access to goods made in the US, which often come with confidence in quality and labor standards.

Export controls, sanctions, or diplomatic disputes may still disrupt critical inputs such as semiconductors, critical minerals, or energy components.

Reshoring and nearshoring increase fixed costs. If global demand slows or inflation persists, higher cost structures can compress margins and reduce competitiveness.

Firms that restructure supply chains during economic downturns risk stranded assets if projected demand does not materialize. Currency volatility and interest rate fluctuations also affect cross-border investments in Mexico, Canada, and allied economies.

Workforce and Talent Pipeline

Advanced manufacturing requires engineers, technicians, data analysts, and automation specialists. The current US labor market does not supply these skills at a sufficient scale. Training pipelines lag capital deployment. Without coordinated investment in technical education, apprenticeships, and immigration pathways for skilled labor, new facilities will face chronic understaffing and lower productivity.

Cost Competitiveness and the Business Case

The U.S. based and allied manufacturing struggles to match Asia on unit cost. Energy prices, labor costs, and regulatory compliance raise production expenses. The business case for reshoring depends on valuing resilience, reliability, and risk reduction. Many firms still lack internal frameworks to quantify these benefits, making investment decisions harder to justify to shareholders focused on short-term returns.

- Align industrial policy with workforce strategy. Capital subsidies must be matched with funding for technical education, community colleges, and apprenticeship programs tied directly to new manufacturing projects.

- Build redundancy into trade policy. Avoid concentrating friend-shoring incentives in a narrow set of countries. Broaden alliances across regions to prevent new single points of failure.

- Accelerate permitting and infrastructure delivery. Delays in zoning, environmental reviews, and grid access increase execution risk and discourage private investment.

- Standardize resilience metrics. Develop national frameworks for measuring supply chain risk so firms can incorporate resilience into financial decision-making.

For Multinational Corporations

- Adopt portfolio based supply chain design. Balance cost-efficient global sourcing with regional redundancy rather than pursuing full reshoring or full globalization.

- Invest in digital visibility. Real-time tracking, scenario modeling, and supplier risk analytics are now core operating capabilities, not optional upgrades.

- Build long-term supplier partnerships. Stability comes from co-investment, shared data, and joint contingency planning with suppliers in Mexico, the US, and allied economies.

- Quantify resilience value. Incorporate downtime risk, revenue loss, and reputational impact into capital allocation models.

- Reprice resilience. Favor firms with diversified sourcing, regional manufacturing footprints, and strong supply chain governance.

- Target infrastructure and enablers. Logistics, grid modernization, industrial real estate, and supply chain software benefit directly from regionalization trends.

- Assess execution capability. Capital alone is insufficient. Management teams with proven experience in large-scale industrial projects will outperform.

- Take a long-horizon view. Returns from reshoring and friend-shoring accrue over years, not quarters.

- The US supply chain model is shifting from cost minimization to risk minimization.

- Reshoring, nearshoring, and friend-shoring now define industrial strategy.

- Government policy is actively reshaping manufacturing geography.

- Mexico and allied economies are gaining lasting strategic importance.

- Companies that invest early in supply chain visibility and redundancy will outperform.

- Supply chain resilience is now a competitive advantage, not a contingency cost.

1. What is the US Supply Chain Transformation?

2. Why is the US reshoring and nearshoring manufacturing?

The US is reshoring and nearshoring to reduce dependence on China, limit exposure to geopolitical risk, shorten supply lines, and prevent disruptions like those seen during the COVID-19 pandemic.

3. What is friend-shoring in supply chains?

4. How does supply chain regionalization affect businesses?

Regionalized supply chains increase resilience and reliability but raise production costs, requiring firms to invest in automation, digital visibility, and diversified supplier networks.