Canada's Net Zero Advantage: How The Shift To A Clean Energy Economy Will Redefine Its Global Leadership

From Alberta’s oil sands to Quebec’s hydroelectric grid, the country is balancing its identity as a resource powerhouse with its ambition to become a climate innovation leader.

The central question is whether Canada can turn climate ambition into economic advantage while managing regional tensions, regulatory complexity, and rapidly shifting global pressures.

Canada’s Green Transition: Why This Decade Matters

Canada’s energy landscape presents a defining paradox.

It holds the world’s third-largest proven oil reserves after Venezuela and Saudi Arabia. Canada's oil reserves are centered in Alberta, yet provinces like Quebec already run some of the cleanest electricity systems globally, powered largely by hydropower (CAPP).

This duality creates both friction and opportunity.

The federal commitment to reduce emissions 45–50% below 2005 levels by 2030 signals a shift toward climate policy as an engine of economic restructuring.

The core idea shaping federal strategy is simple: climate action is economic opportunity.

National Climate Policy and Canada’s Net-Zero Strategy

Canada’s nationally determined contribution under the Paris Agreement sets the framework for its net-zero pathway. The federal government’s 2025–26 climate plan emphasizes:

- Expansion of clean electricity.

- Innovation-driven economic growth.

- Resilient low-carbon infrastructure.

The Royal Bank of Canada estimates that the transition could generate 235,000–400,000 jobs over the next decade.

Labour data from 2022 already identified 327,506 clean-tech manufacturing jobs, underscoring the growing momentum behind Canada’s climate economy.

Clean-Tech Investment and Innovation in Canada’s Energy Economy

A cornerstone of Canada’s clean-energy strategy is rapid innovation and scaling of new technologies. Federal policies aim to expand climate-tech start-ups, boost industrial decarbonization, and grow advanced manufacturing.

Canada’s clean-tech ecosystem benefits from:

- Abundant natural resources.

- Strong research universities.

- Early leadership in carbon pricing.

- Access to U.S. and EU markets

Key Federal Incentives Driving Canada’s Clean Energy Growth

Federal investment tax credits are designed to accelerate private capital deployment and strengthen clean-energy competitiveness.

Major incentives include:

• 15% Clean Electricity Investment Tax Credit

Supports non-emitting electricity generation, interprovincial grid connections, and modernization of the national grid.

• Expanded Clean Tech Eligibility

Includes small modular reactors (SMRs) and additional low-carbon heat and power technologies.

• Over $2 Billion for Critical Minerals

Aimed at scaling production of key inputs for EV batteries, wind turbines, solar components, and energy storage.

• 30% Clean Technology Manufacturing Investment Tax Credit (CTM-ITC)

Boosts domestic production of clean-tech machinery and critical mineral processing.

Collectively, these incentives form the backbone of Canada’s clean-energy industrial strategy.

Major Clean Energy Projects Reshaping Canada’s Economy

Several flagship projects illustrate the scale of Canada’s ambitions:

• Darlington New Nuclear Project

A next-generation nuclear facility capable of generating 1,200 MW, powering up to 1.2 million homes.

• Electric Vehicle Charging Infrastructure Expansion

A nationwide deployment aimed at supporting EV adoption and decarbonizing road transportation.

• Clean Fuels Fund

A $1.5-billion federal initiative, extended to 2030, to scale domestic production of clean fuels such as renewable diesel, hydrogen, and sustainable aviation fuel.

These projects strengthen clean-energy supply, create jobs, and support domestic manufacturing.

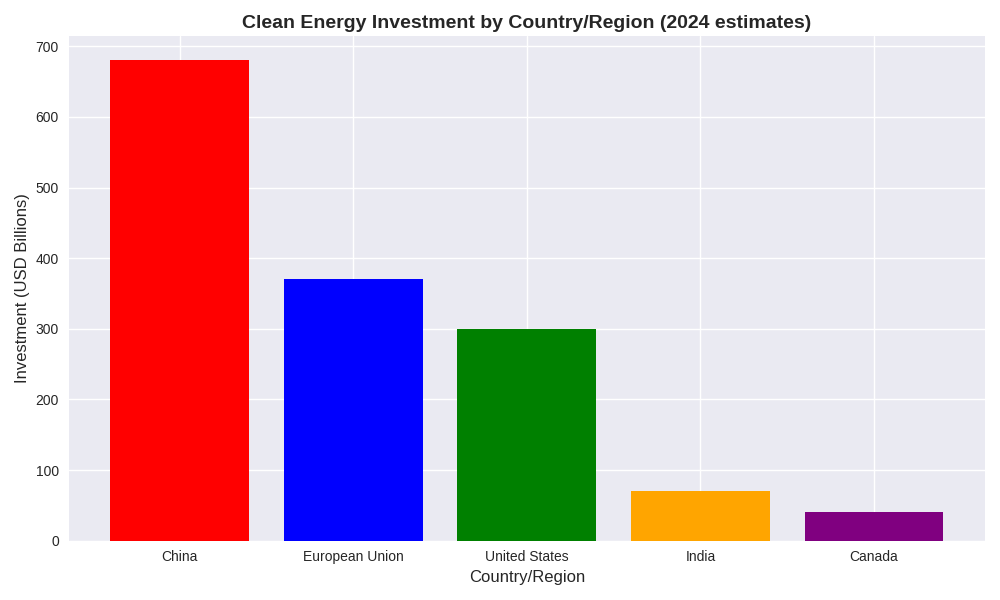

- China leads with $680 billion in clean energy investment.

- European Union follows with $370 billion.

- United States invests $300 billion.

- India contributes $70 billion.

- Canada rounds out with $40 billion.

Despite progress, Canada’s green transition faces significant regional challenges.

Alberta’s Restrictions on Wind Development

Alberta’s decision to restrict wind turbines in specific landscapes and agricultural areas highlights ongoing tensions between traditional energy sectors and emerging renewable industries.

Industrial Legacy vs. Clean Energy Imperatives

Canada must reconcile decades of fossil-fuel infrastructure with the demands of a rapidly evolving clean-energy economy.

This tension often shapes political debates, investment decisions, and regional policy differences.

Critical Minerals and Canada’s Role in Global Supply Chains

Critical minerals including lithium, nickel, cobalt, graphite, and rare earth elements, are essential to EVs, batteries, renewable energy systems, and defense technologies.

Canada aims to become a global hub for critical mineral extraction and processing to reduce reliance on China’s dominant supply chains.

But challenges remain:

- Long permitting timelines.

- Environmental assessments.

- Indigenous consultation requirements.

- Infrastructure gaps in remote regions.

Regulatory Barriers, Governance Risks, and Investment Uncertainty

Predictable regulatory frameworks are crucial for attracting private investment in clean energy.

However, Canada’s governance landscape often complicates large-scale project development due to:

- Overlapping federal–provincial authority.

- Slow permitting and impact assessments.

- Inconsistent policy timelines.

- Risk-averse public-sector decision-making.

But implementation remains a major challenge and delays can affect investor confidence.

AI, Energy Demand, and Emerging Risks to the Clean-Energy Transition

Artificial intelligence and large-scale data centers are emerging as significant new stressors on Canada’s electricity system.

Data centers require enormous amounts of electricity and water for cooling.

As AI adoption accelerates, Canadian utilities may face energy shortfalls as early as 2027 if supply fails to keep pace with demand.

This creates new risks for the clean-energy transition:

- Grid strain.

- Increased fossil peaker use.

- Delayed decarbonization timelines.

- Competition between industries for clean electricity.

Long-Term Wealth Creation Through Canada’s Clean Energy Economy

Canada’s green transition represents one of the most significant nation-building opportunities of this century.

Clean technologies, critical minerals, electrified industry, and low-carbon exports could form the foundation of a new era of national wealth.

But success depends on:

- Regulatory predictability.

- Infrastructure modernization.

- Alignment between federal and provincial governments.

- Rapid scaling of clean technologies.

- Long-term investment certainty.

If Canada can turn its climate commitments into executed strategy, it can lead globally in climate innovation and secure a prosperous net-zero future.

The transition to net-zero is an industrial marathon, and Canada stands at a pivotal moment to shape the next generation of national wealth.

Key Takeaways: What Canada’s Clean Energy Transition Means for Its Economy and Net-Zero Future

- Canada is using its dual identity as an oil producer and clean-energy leader to fuel a major economic shift toward net-zero growth.

- Federal climate policies especially tax credits, clean electricity incentives, and critical-mineral investments, are designed to accelerate clean-tech innovation and job creation.

- Regulatory uncertainty, fragmented jurisdiction, and policy delays pose significant risks to clean-energy deployment and investor confidence.

- Regional frictions, including Alberta’s restrictions on renewables and Canada’s dependence on global mineral supply chains, threaten the pace of the energy transition.

- The green transition represents a long-term wealth-creation strategy for Canada, but only if policy execution aligns with climate commitments and economic targets.