A gavel striking blocks labeled ''Tax'' with coins on top symbolizing legal and financial aspects of taxes. Photo Credits: Lextalk World

A gavel striking blocks labeled ''Tax'' with coins on top symbolizing legal and financial aspects of taxes. Photo Credits: Lextalk World

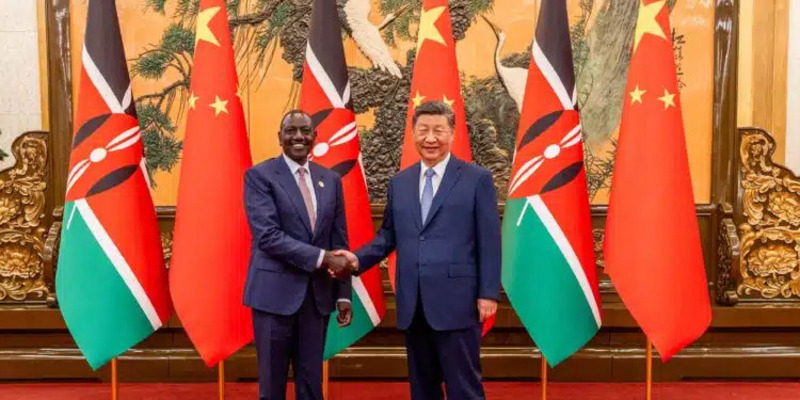

Tax Inequity Unveiled: The Growing Divide In Kenya's Fiscal Landscape

Africa

Business

Proposed Tax Measures and Their Economic Implications

The Finance Bill 2024 outlines several controversial proposals, including:

- A 15% withholding tax on income earned through digital content monetization

- An increase in VAT on petroleum products from 8% to 16%,

- Higher taxes on beauty products

- A mandatory 3% salary deduction to fund affordable housing programs

Each of these measures carries profound implications for consumers, businesses, and the overall economy.

Impact on Kenya's Digital Economy and Youth Employment

The proposed hike in the digital tax could severely harm the emerging digital content industry, a key livelihood for many Kenyan youths. Digital creation offers enormous growth potential, particularly as the economy becomes more technology-driven. Overburdening this sector risks stifling innovation and diminishing a future revenue stream for the government itself.

Increasing Consumer Burden and Risking Economic Dysfunction

Sharp tax increases would likely trigger a major disruption in consumption patterns. With the already high cost of living, any additional burden could push more consumers below the poverty line. Rather than fostering economic uplift, such measures may cripple the middle and lower classes, leading to broader social and economic instability.

A Call for Gradual, Data-Driven Tax Reform

Instead of sudden, sweeping tax hikes, the government should focus on gradually broadening the tax base while maintaining reasonable tax rates. Thoughtful, data-driven policy decisions are critical to avoid unintended consequences that could weaken the economy rather than strengthen it.

Black Tax and Declining Savings: A Warning Sign

As "black tax"—the financial burden placed on individuals to support extended family members—increases, Kenya’s national savings rate continues to decline. Many Kenyans live paycheck to paycheck, leaving little room for savings, investment, or economic growth. Aggressive taxation could further erode the already fragile financial resilience.