A person holding a “Taxed to the Limit” placard symbolizing the economic pressure on ordinary people. Image: AI generated

A person holding a “Taxed to the Limit” placard symbolizing the economic pressure on ordinary people. Image: AI generated

Kenya’s Public Debt Trap: Examining The Risks, Political Accountability, And The Path To Economic Stability

As countries worldwide aim for economic stability and independence, Kenya's debt levels are significantly rising. In fact, the country is almost experiencing an economic shutdown. Historically, Kenya has maintained relatively moderate debt levels. However, over the past decade, borrowing has surged, with the government defending this trend as part of its commitment to infrastructural and economic expansion.

Kenya's borrowing culture and spending have become a key concern for both citizens and the political class, sparking debates about the intent behind borrowing, transparency, and repayment strategies. Some critics argue that it constitutes an odious debt. Despite available records on Kenya’s debt, alarm bells rang in 2024 when citizens protested against the government’s borrowing habits. In response, President William Ruto recommended an audit—an initiative that has yet to be substantiated.

Past Debt Trends

A review of Kenya's debt trajectory over the past decade highlights drastic changes in borrowing habits. In the 2008/2009 financial year, public debt stood at 45.8% of GDP, rising to 50.9% in 2009/2010. Between 2013 and 2020, the debt stock increased by 300%, leading to high debt servicing costs. By December 2021, the Central Bank of Kenya reported the country’s public debt at Ksh 8.4 trillion.

Current Debt Situation

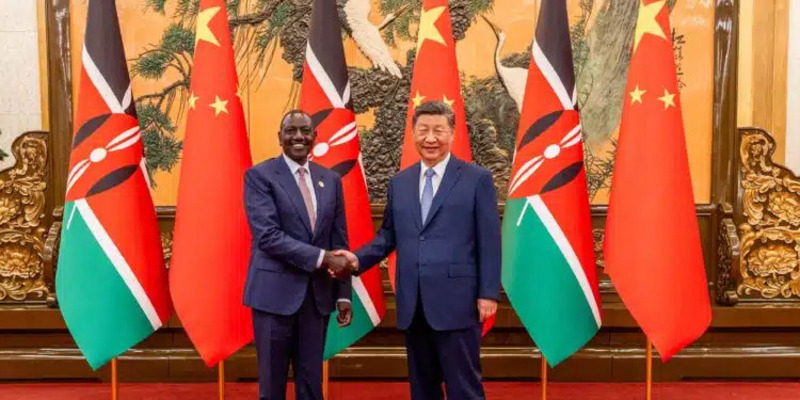

Since 2021, Kenya's debt has grown from Ksh 8.4 trillion to Ksh 10.6 trillion (USD 82.5 billion) as of June 2024. Following additional borrowings, the debt is projected to reach Ksh 11 trillion by 2025, surpassing the country’s debt ceiling, which should not exceed 60% of GDP. Interestingly, despite the debt-to-GDP ratio reaching 70%—20% beyond the IMF threshold for developing countries—Kenya continues to borrow. In April 2025, President William Ruto traveled to China to negotiate a Ksh 200 billion loan.

Debt Servicing Challenges

With public debt exceeding its ceiling, Kenya has breached national financial regulations and IMF-recommended debt sustainability ratios. This alone signals a heightened risk of debt distress. In the fiscal year 2024/2025, Kenya is expected to allocate Ksh 1.1 trillion for interest payments and Ksh 843.4 billion for debt redemption.

Intent Behind Borrowing

The Kenyan government consistently defends its borrowing, citing the need for infrastructure development and economic expansion. However, critics argue that a significant portion of borrowed funds is lost to corruption. Many question why the government borrows for projects with minimal economic returns, inflated costs, and incomplete outcomes.

The Standard Gauge Railway (SGR) project exemplifies such inefficiencies, with reported irregularities in its cost structure. Political leaders and the Ethics and Anti-Corruption Commission (EACC) claim that corruption consumes a substantial portion of borrowed funds. Former President Uhuru Kenyatta once stated that Kenya loses Ksh 2 billion daily to corruption. Additionally, the EACC estimates that 7.8% of GDP is lost to corruption.

Given this reality, many argue that Kenya should prioritize closing corruption loopholes before seeking more loans. Despite widespread allegations, few individuals are held accountable for corruption, and most cases result in acquittals even when evidence is presented. This raises concerns about whether borrowing is genuinely intended for development or simply funds mismanagement.

Key Concerns

Kenya's debt ceiling has already exceeded its limit, yet the government continues to borrow. The resulting debt distress forces the country to seek expensive loans at high interest rates, increasing repayment burdens. As a consequence, future government income will largely be directed toward debt repayment rather than development projects.

To raise revenue, Kenya has resorted to controversial taxation measures, including the Finance Bills of 2023 and 2024. These policies have imposed additional economic strain on citizens. Furthermore, the absence of debt sustainability reassessment has exacerbated borrowing, pushing the country into a severe debt trap. This constricts fiscal space and limits the government’s ability to provide essential services and development initiatives.

Future Implications

Due to high debt servicing costs, Kenya may face significant fiscal pressure, potentially reducing funding for critical sectors such as education and infrastructure. With the government failing to meet debt sustainability thresholds, the risk of severe debt distress remains high.

Additionally, Kenya's economic growth is expected to decline further, with the World Bank forecasting a 4.7% growth rate in 2024. If taxation continues to increase to meet debt repayment demands, citizens may escalate protests, causing further social unrest.

Recommendations

While Kenya, like many nations, is undergoing economic transformation, the government must address its public debt issue. Many Kenyans argue that borrowing is less about development and more about sustaining corrupt practices. Despite trillions in debt, citizens see little progress compared to the burden they bear.

To ensure financial accountability, Kenya should conduct a thorough debt audit to determine how funds were spent and recover lost money where possible. Additionally, the country must explore sustainable alternatives to borrowing, such as improving domestic revenue generation and collection. Most importantly, since citizens carry the debt burden, the government should heed their concerns and borrow within sustainable limits.

Kenya's borrowing culture and spending have become a key concern for both citizens and the political class, sparking debates about the intent behind borrowing, transparency, and repayment strategies. Some critics argue that it constitutes an odious debt. Despite available records on Kenya’s debt, alarm bells rang in 2024 when citizens protested against the government’s borrowing habits. In response, President William Ruto recommended an audit—an initiative that has yet to be substantiated.

Past Debt Trends

A review of Kenya's debt trajectory over the past decade highlights drastic changes in borrowing habits. In the 2008/2009 financial year, public debt stood at 45.8% of GDP, rising to 50.9% in 2009/2010. Between 2013 and 2020, the debt stock increased by 300%, leading to high debt servicing costs. By December 2021, the Central Bank of Kenya reported the country’s public debt at Ksh 8.4 trillion.

Current Debt Situation

Since 2021, Kenya's debt has grown from Ksh 8.4 trillion to Ksh 10.6 trillion (USD 82.5 billion) as of June 2024. Following additional borrowings, the debt is projected to reach Ksh 11 trillion by 2025, surpassing the country’s debt ceiling, which should not exceed 60% of GDP. Interestingly, despite the debt-to-GDP ratio reaching 70%—20% beyond the IMF threshold for developing countries—Kenya continues to borrow. In April 2025, President William Ruto traveled to China to negotiate a Ksh 200 billion loan.

Debt Servicing Challenges

With public debt exceeding its ceiling, Kenya has breached national financial regulations and IMF-recommended debt sustainability ratios. This alone signals a heightened risk of debt distress. In the fiscal year 2024/2025, Kenya is expected to allocate Ksh 1.1 trillion for interest payments and Ksh 843.4 billion for debt redemption.

Intent Behind Borrowing

The Kenyan government consistently defends its borrowing, citing the need for infrastructure development and economic expansion. However, critics argue that a significant portion of borrowed funds is lost to corruption. Many question why the government borrows for projects with minimal economic returns, inflated costs, and incomplete outcomes.

The Standard Gauge Railway (SGR) project exemplifies such inefficiencies, with reported irregularities in its cost structure. Political leaders and the Ethics and Anti-Corruption Commission (EACC) claim that corruption consumes a substantial portion of borrowed funds. Former President Uhuru Kenyatta once stated that Kenya loses Ksh 2 billion daily to corruption. Additionally, the EACC estimates that 7.8% of GDP is lost to corruption.

Given this reality, many argue that Kenya should prioritize closing corruption loopholes before seeking more loans. Despite widespread allegations, few individuals are held accountable for corruption, and most cases result in acquittals even when evidence is presented. This raises concerns about whether borrowing is genuinely intended for development or simply funds mismanagement.

Key Concerns

Kenya's debt ceiling has already exceeded its limit, yet the government continues to borrow. The resulting debt distress forces the country to seek expensive loans at high interest rates, increasing repayment burdens. As a consequence, future government income will largely be directed toward debt repayment rather than development projects.

To raise revenue, Kenya has resorted to controversial taxation measures, including the Finance Bills of 2023 and 2024. These policies have imposed additional economic strain on citizens. Furthermore, the absence of debt sustainability reassessment has exacerbated borrowing, pushing the country into a severe debt trap. This constricts fiscal space and limits the government’s ability to provide essential services and development initiatives.

Future Implications

Due to high debt servicing costs, Kenya may face significant fiscal pressure, potentially reducing funding for critical sectors such as education and infrastructure. With the government failing to meet debt sustainability thresholds, the risk of severe debt distress remains high.

Additionally, Kenya's economic growth is expected to decline further, with the World Bank forecasting a 4.7% growth rate in 2024. If taxation continues to increase to meet debt repayment demands, citizens may escalate protests, causing further social unrest.

Recommendations

While Kenya, like many nations, is undergoing economic transformation, the government must address its public debt issue. Many Kenyans argue that borrowing is less about development and more about sustaining corrupt practices. Despite trillions in debt, citizens see little progress compared to the burden they bear.

To ensure financial accountability, Kenya should conduct a thorough debt audit to determine how funds were spent and recover lost money where possible. Additionally, the country must explore sustainable alternatives to borrowing, such as improving domestic revenue generation and collection. Most importantly, since citizens carry the debt burden, the government should heed their concerns and borrow within sustainable limits.

Senior Editor: Kenneth Njoroge

Financial Expert/Bsc. Commerce/CPA