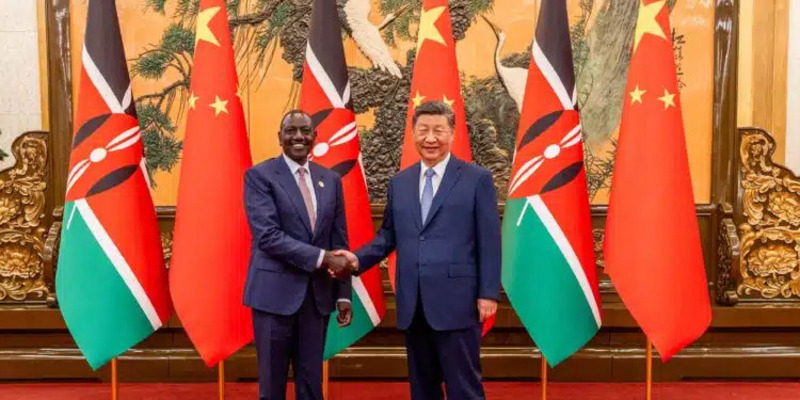

Financial literacy status in Kenya. Photo Credits: Samuel Pedrosa via Pixabay

Financial literacy status in Kenya. Photo Credits: Samuel Pedrosa via Pixabay

Financial Literacy Crisis: Bridging The Present And Future Of Kenya's Financial Literacy

Financial literacy—the ability to understand and effectively manage financial matters—is essential for individual prosperity and national economic growth. However, in Kenya, financial literacy levels are alarmingly low, with only 38% of adults demonstrating basic financial understanding. This deficiency has far-reaching implications, including increased poverty rates, limited financial inclusion, and economic inequality.

Global and Regional Financial Literacy Comparisons

A global survey revealed that many Kenyans struggle with fundamental financial concepts such as risk diversification, interest calculations, and transaction costs. In contrast, European countries boast high financial literacy rates, with Denmark, Norway, and Sweden at 71% and Canada at 68%. Globally, only 33% of adults are financially literate, leaving 67%—or 3.5 billion people—lacking basic financial knowledge.

In Africa, Botswana leads with a financial literacy rate of 52%, followed by South Africa at 42% and Kenya at 38%. Somalia ranks lowest in the region, with a rate of just 15%. This disparity underscores the urgent need for comprehensive financial education initiatives in Kenya and beyond.

The Impact of Mobile Loans and Debt Management

The rise of mobile loan applications has made borrowing more accessible, but many users lack an understanding of interest rates and repayment terms. By May 2023, approximately 19.97 million loan accounts were blacklisted by the Credit Reference Bureau, reflecting widespread challenges in debt management. This financial instability limits access to future credit and exacerbates economic hardships for many Kenyans.

Savings Behaviors and Investment Awareness

While 74% of Kenyans reportedly engage in saving behaviors, most rely on mobile money wallets, which offer minimal interest and lack long-term growth potential. This trend highlights the need for increased awareness of diversified savings and investment instruments that can yield better returns and promote financial security.

The Role of Education in Financial Literacy

Kenya’s education system lacks a standardized curriculum focusing on personal finance, leaving graduates unprepared to navigate financial challenges. Integrating financial education into schools could equip students with essential skills for financial well-being. Gender disparities in saving behaviors also persist, with 74% of men saving compared to 73% of women in 2021. Targeted interventions are needed to promote financial inclusion for all.

The Influence of Informal Financial Systems

Many Kenyans rely on informal financial systems like chamas (savings groups), which, while beneficial, may not provide comprehensive financial tools and knowledge. Factors such as high banking fees, strict loan requirements, and long distances to bank branches push many toward these informal systems. However, this reliance can limit exposure to formal financial education, structured investments, and modern banking services.

Including financial education within chamas and encouraging members to engage with formal financial institutions could help bridge the financial literacy gap.

Initiatives to Enhance Financial Literacy

Organizations like the Kenya Bankers Association have launched campaigns to improve public understanding of financial matters. Collaborative efforts between financial institutions, educational bodies, and the government can amplify these initiatives, ensuring they reach diverse populations, including those in rural areas.

Regulating Mobile Loan Providers

The government should enforce stricter regulations on mobile loan providers to ensure transparency in interest rates and lending terms. Such measures can protect consumers from predatory lending practices and promote responsible borrowing.

Bridging the Financial Literacy Gap

Addressing Kenya’s low financial literacy levels is crucial for fostering individual financial stability and national economic development. By implementing comprehensive education programs, promoting inclusive financial practices, and regulating lending platforms, stakeholders can work together to bridge the financial literacy gap. Empowering Kenyans with the knowledge and tools to manage their finances effectively will pave the way for a more sustainable and prosperous society.

Global and Regional Financial Literacy Comparisons

A global survey revealed that many Kenyans struggle with fundamental financial concepts such as risk diversification, interest calculations, and transaction costs. In contrast, European countries boast high financial literacy rates, with Denmark, Norway, and Sweden at 71% and Canada at 68%. Globally, only 33% of adults are financially literate, leaving 67%—or 3.5 billion people—lacking basic financial knowledge.

In Africa, Botswana leads with a financial literacy rate of 52%, followed by South Africa at 42% and Kenya at 38%. Somalia ranks lowest in the region, with a rate of just 15%. This disparity underscores the urgent need for comprehensive financial education initiatives in Kenya and beyond.

The Impact of Mobile Loans and Debt Management

The rise of mobile loan applications has made borrowing more accessible, but many users lack an understanding of interest rates and repayment terms. By May 2023, approximately 19.97 million loan accounts were blacklisted by the Credit Reference Bureau, reflecting widespread challenges in debt management. This financial instability limits access to future credit and exacerbates economic hardships for many Kenyans.

Savings Behaviors and Investment Awareness

While 74% of Kenyans reportedly engage in saving behaviors, most rely on mobile money wallets, which offer minimal interest and lack long-term growth potential. This trend highlights the need for increased awareness of diversified savings and investment instruments that can yield better returns and promote financial security.

The Role of Education in Financial Literacy

Kenya’s education system lacks a standardized curriculum focusing on personal finance, leaving graduates unprepared to navigate financial challenges. Integrating financial education into schools could equip students with essential skills for financial well-being. Gender disparities in saving behaviors also persist, with 74% of men saving compared to 73% of women in 2021. Targeted interventions are needed to promote financial inclusion for all.

The Influence of Informal Financial Systems

Many Kenyans rely on informal financial systems like chamas (savings groups), which, while beneficial, may not provide comprehensive financial tools and knowledge. Factors such as high banking fees, strict loan requirements, and long distances to bank branches push many toward these informal systems. However, this reliance can limit exposure to formal financial education, structured investments, and modern banking services.

Including financial education within chamas and encouraging members to engage with formal financial institutions could help bridge the financial literacy gap.

Initiatives to Enhance Financial Literacy

Organizations like the Kenya Bankers Association have launched campaigns to improve public understanding of financial matters. Collaborative efforts between financial institutions, educational bodies, and the government can amplify these initiatives, ensuring they reach diverse populations, including those in rural areas.

Regulating Mobile Loan Providers

The government should enforce stricter regulations on mobile loan providers to ensure transparency in interest rates and lending terms. Such measures can protect consumers from predatory lending practices and promote responsible borrowing.

Bridging the Financial Literacy Gap

Addressing Kenya’s low financial literacy levels is crucial for fostering individual financial stability and national economic development. By implementing comprehensive education programs, promoting inclusive financial practices, and regulating lending platforms, stakeholders can work together to bridge the financial literacy gap. Empowering Kenyans with the knowledge and tools to manage their finances effectively will pave the way for a more sustainable and prosperous society.

Senior Editor: Kenneth Njoroge

Financial Expert/Bsc. Commerce/CPA