5 min read

Venezuela's Geopolitical Power Play: Reshaping Latin America With Oil, Alliances, And An Esg Deficit

SouthAmerica

Politics

Venezuela is reasserting itself as a geopolitical disruptor in the Western Hemisphere, leveraging vast oil reserves, ideological alliances, and defiance of Western sanctions to challenge U.S. influence. Its actions reverberate across global energy markets, diplomatic corridors, and ESG governance debates, positioning Caracas as both a regional agitator and a case study in resource-based resilience.

Historical Roots of Economic Instability

Historical Roots of Economic Instability

Venezuela’s economic crisis is deeply rooted in the Chávez era of resource nationalism and institutional erosion.

- Populist oil dependence: Hugo Chávez (1999–2013) used oil revenues to fund massive social programs, creating fiscal dependence on volatile oil prices (Council on Foreign Relations).

- Industrial decline: Nationalization and price controls led to “Dutch disease,” where oil crowded out other productive sectors.

- Hyperinflation and collapse: By 2019, hyperinflation exceeded 10 million percent due to monetary expansion and currency devaluation (FasterCapital).

- Sanctions and humanitarian fallout: Global oil price shocks and U.S. sanctions deepened the collapse, prompting mass migration and humanitarian crises (IJCRT).

Resource Nationalism and Energy Diplomacy

Venezuela, home to the world’s largest proven oil reserves, continues to use energy diplomacy to defy isolation and re-enter global markets.

Venezuela, home to the world’s largest proven oil reserves, continues to use energy diplomacy to defy isolation and re-enter global markets.

- China and Brazil investments: Billions poured into oil infrastructure and joint ventures, bypassing Western sanctions.

- Iranian cooperation: Fuel supplies and technical aid have deepened logistical and ideological ties.

- Alternative trade systems: PDVSA has resumed limited exports to India and Turkey via barter and crypto-based deals.

- This “energy defiance” undermines Western control over oil markets and opens new pathways for South-South energy cooperation.

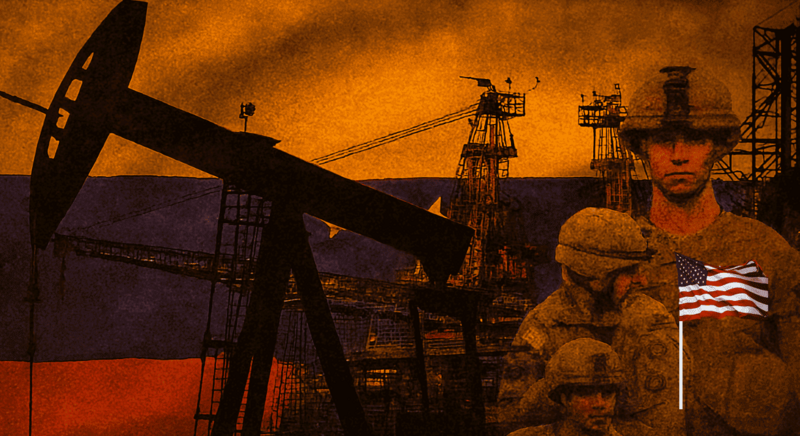

Militarization and Regional Tensions

In August 2025, the U.S. deployed 4,000 Marines and eight naval vessels near Venezuelan waters under an anti-narcotics pretext. Caracas retaliated with military drills and outreach to allies including China, Brazil, and Iran.

In August 2025, the U.S. deployed 4,000 Marines and eight naval vessels near Venezuelan waters under an anti-narcotics pretext. Caracas retaliated with military drills and outreach to allies including China, Brazil, and Iran.

- $700M Venezuelan assets frozen by the U.S. Treasury (DW).

- Sovereignty dispute: Maduro denounced U.S. maneuvers as violations of sovereignty, inflaming regional sentiment.

- Regional response: Colombia and Argentina monitor closely, wary of spillover and destabilization.

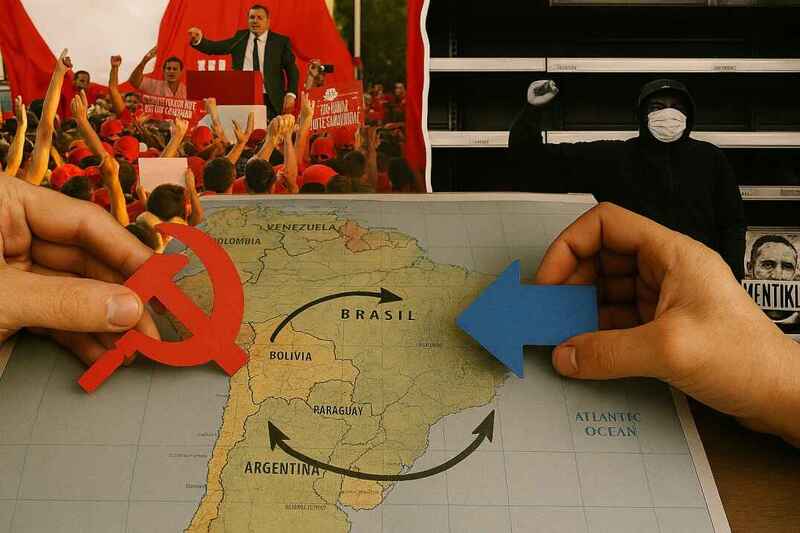

Strategic Alliances and Global Influence

Venezuela’s non-Western alliances strengthen its defiance and amplify its global footprint.

- China: Provides surveillance tech, loans, and diplomatic cover.

- Brazil: Offers energy cooperation, ESG expertise, and pragmatic regional support.

- Iran: Supplies fuel and ideological solidarity.

These partnerships form a multipolar bloc challenging U.S. hegemony and reshaping Global South diplomacy.

Domestic Perception and Political Legitimacy

Despite assertive foreign policy, domestic skepticism runs deep.

- Citizens see global posturing as distraction from poverty, corruption, and service collapse (CFR).

- Low institutional trust and protests follow contested elections.

- The government’s narrative of “anti-imperialist resistance” seeks to consolidate support amid despair.

ESG Blind Spot: Governance and Sustainability Risks

Venezuela ranks among the lowest in governance and environmental standards in Latin America.

- Environmental degradation: Orinoco Belt oil extraction has caused deforestation, water pollution, and Indigenous displacement.

- Corruption: Transparency International places Venezuela near the global bottom.

- Weak ESG framework: Virtually absent, deterring sustainability-focused investors.

.png)

Venezuela’s ESG score of 42 is the lowest among peers, underscoring deep sustainability and governance risks.

Regional Relationships and Diplomatic Outlook

Regional Relationships and Diplomatic Outlook

Venezuela’s regional diplomacy balances defiance with pragmatism.

- Brazil: Offers energy cooperation yet remains wary of destabilization.

- Uruguay: A governance benchmark with strong institutions and transparency.

- Mexico: Maintains neutrality and often mediates in regional forums.

- Chile & Colombia: Prioritize rule-based diplomacy and ESG compliance.

Venezuela’s aggressive posture could alienate democratic neighbors, but shared interests in resource sovereignty may enable selective collaboration.

Key Insights (2025)

Key Insights (2025)

- Venezuela’s ESG score (38) remains the lowest in the region, reflecting governance and environmental decline.

- China, Brazil, and Iran are its primary strategic partners, helping bypass sanctions.

- South American resource nationalism may spread, with Bolivia and Suriname exploring similar assertive models.

- Global energy markets are shifting as Venezuela re-enters via barter and crypto trade.

- U.S. military deployments and Venezuelan mobilization heighten escalation risks.

The Stakes Ahead: What Lies Beyond 2025

Venezuela’s trajectory will shape global debates over sovereignty, energy security, and ethical governance.

Key considerations for policymakers and investors include:

Key considerations for policymakers and investors include:

- Balancing deterrence and diplomacy: Avoid escalation while addressing ideological divides.

- Promoting ESG reform: Transparency and sustainability can stabilize Latin American supply chains.

- Monitoring resource-backed alliances: Oil and minerals may become leverage in global voting blocs.

- Studying Uruguay’s model: Robust governance and fiscal discipline provide a regional blueprint for credibility

Senior Editor: Kenneth Njoroge

Business & Financial Expert | MBA | Bsc. Commerce | CPA