A representation of Shifting Tech Supply Chains, The Global Factory Race with China as a focal point of industries. Image Credits: AI generated

A representation of Shifting Tech Supply Chains, The Global Factory Race with China as a focal point of industries. Image Credits: AI generated

The 'Anything But China' Tech Revolution: Can Vietnam, India & Mexico Replace The World's Factory?

The Shifting Landscape of Global Tech Manufacturing: Can China’s Dominance Be Challenged? For decades, China has been the world’s leading supplier of technology products, from smartphones and semiconductors to consumer electronics. Its robust infrastructure, skilled workforce, and efficient supply chains have made it the go-to hub for global manufacturing. However, recent geopolitical tensions, trade restrictions, and rising costs are forcing companies to rethink their reliance on China.

The Rise of "Anything But China" Strategies

The U.S.-China techno-rivalry has led Western companies to adopt a diversification strategy, often summarized as "Anything But China" (ABC), to reduce supply chain risks. The U.S. imposed 25% tariffs on select Chinese imports in 2018. It has been layered with new measures, including additional tariffs and revisions bringing the effective rate on some goods as high as 55% in 2025, while the CHIPS and Science Act (2022) allocated $52.7 billion in subsidies to boost domestic semiconductor production, with strict restrictions on investments in China. These measures have pushed tech giants like Apple, Samsung, and Google to expand production in Vietnam, India, and Mexico.

Emerging Manufacturing Hubs: Who Benefits?

Case Study: Apple's Vietnam Pivot

Apple shifted 25% of its production from China to Vietnam by 2024 (Nikkei). Foxconn's $1.5B investment now makes 20M AirPods annually there, though power outages cause 15% downtime (FT).

Apple shifted 25% of its production from China to Vietnam by 2024 (Nikkei). Foxconn's $1.5B investment now makes 20M AirPods annually there, though power outages cause 15% downtime (FT).

Lesson: Diversification works, but it has its growing pains.

Case Study: Intel's Malaysia Chip Play

Intel's $7B Penang plant (opening 2025) taps Malaysia's chip packaging expertise and tax breaks. Local supplier Unisem grew 45% in 2023 (Maybank). Risk: Water scarcity threatens production.

Intel's $7B Penang plant (opening 2025) taps Malaysia's chip packaging expertise and tax breaks. Local supplier Unisem grew 45% in 2023 (Maybank). Risk: Water scarcity threatens production.

Countries like Vietnam, Malaysia, and India are gaining traction as alternative manufacturing bases due to:

- Lower labor costs (compared to China’s rising wages)

- Trade incentives (e.g., India’s Production-Linked Incentive (PLI) scheme)

- Geopolitical neutrality (avoiding U.S.-China tensions)

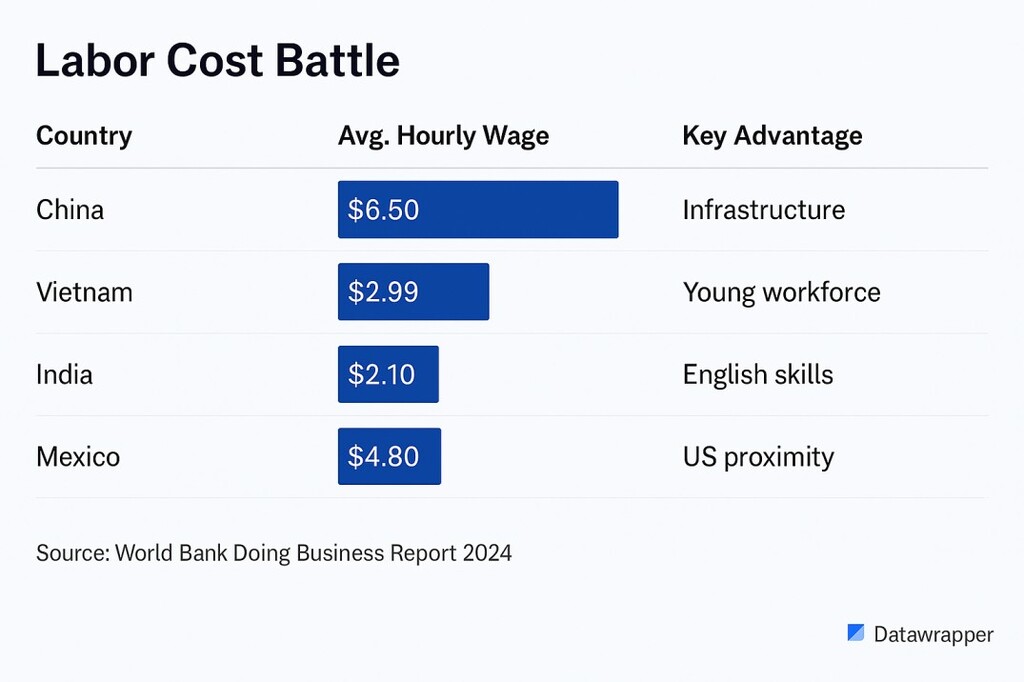

Labor cost across key Tech-Manufacturing Hubs

Malaysia, for instance, has attracted Intel and Micron for chip packaging (Nikkei Asia, 2023), while Vietnam now produces 20% of Apple’s iPads and AirPods (The Wall Street Journal, 2024). Mexico is becoming a key player in nearshoring for the U.S. market, particularly in the electronics and automotive sectors

China’s Countermeasures: Can It Maintain Its Lead?

Despite these shifts, China is not standing still. Key strategies include:

- Accelerating domestic semiconductor production (e.g., SMIC’s 7nm chips despite U.S. sanctions) (South China Morning Post, 2023)

- Expanding the "Made in China 2025" initiative to boost high-tech self-sufficiency (CSIS, 2023)

- Leveraging the Belt and Road Initiative (BRI) to secure new markets and supply chains (Brookings, 2024)

Huawei’s surprise breakthrough with a 5G-capable Kirin 9000S chip (despite U.S. sanctions) shows China’s resilience. Additionally, China still dominates rare earth minerals, crucial for electronics and EVs, giving it long-term leverage.

Challenges in Replacing China

While diversification is underway, completely replacing China remains difficult due to:

- Supply chain gaps – Many alternative hubs still rely on Chinese components.

- Infrastructure limitations – Vietnam faces power shortages, while India struggles with bureaucratic delays (The Economist, 2024).

- Economies of scale – China’s mature ecosystem allows for faster, cheaper production than new entrants.

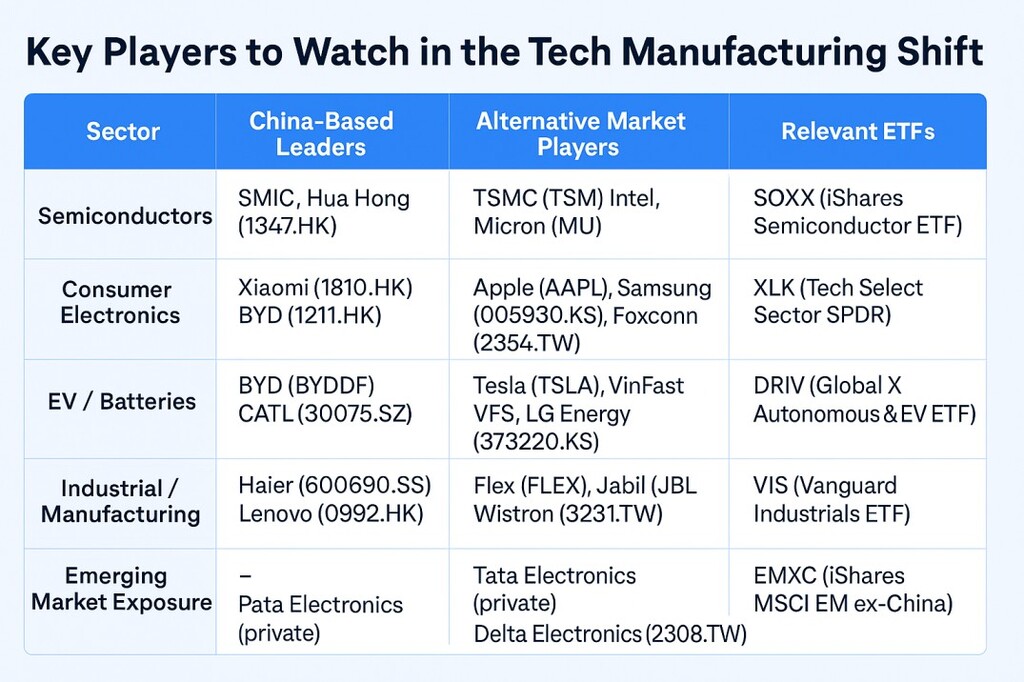

Key Players to watch in Tech Manufacturing Sector

Why This Matters for Investors:

- Diversification Plays: ETFs like EMXC and ASIA reduce China exposure while maintaining EM growth potential.

- Sector-Specific Bets: SOXX (semiconductors) and DRIV (EVs) capture high-growth verticals.

- Direct Stock Opportunities: Companies like TSMC (Taiwan) and Wistron (India/Taiwan) are key beneficiaries of supply chain relocation.

Investment Playbook

- Short-term (1-3 yrs): Volatility as supply chains adjust.

- Long-term (5+ yrs): Bet on both China's innovation and regional alternatives.

- Action: Diversify across geographies, focus on pricing-power sectors.

Risks to Note:

- Geopolitical volatility (e.g., Taiwan-China tensions impacting TSMC).

- Valuation premiums in alternative markets (e.g., Indian stocks trading at high P/Es).

Bottom Line

The manufacturing map is redrawing—stay agile, watch policy shifts, and hedge bets across key regions.

The manufacturing map is redrawing—stay agile, watch policy shifts, and hedge bets across key regions.

Will China Lose Its Manufacturing Crown?

Not anytime soon. While countries like India and Vietnam are growing rapidly, China still accounts for over 30% of global manufacturing output (World Bank, 2024). Its dominance in EVs (BYD outsold Tesla in 2023), 5G, and AI ensures it remains a tech superpower.

However, the "China+1" strategy will continue reshaping global supply chains. The real question is: Can competitors build enough capacity before China adapts? If history is any indicator, China will fight hard to retain its lead.

Senior Editor: Kenneth Njoroge

Financial Expert/Bsc. Commerce/CPA