The image illustrates various aspects of green technology, AI in health, Agri-Tech and Crypto markets adoption in South America. Image credits: AI generated

The image illustrates various aspects of green technology, AI in health, Agri-Tech and Crypto markets adoption in South America. Image credits: AI generated

South America’s $15 T Digital Revolution: Fintech, Ag Tech & The Silent Surge Outpacing Silicon Valley.

SouthAmerica

Business

The market landscape in South America is rapidly changing. Imagine tech-driven agriculture, digital currencies, record-breaking trade agreements, fast-moving e-commerce, and significant investment interest. However, there are layers to the market—national, regional, and international—so it's not all plain sailing. This article explores the major growth drivers, risks, and strategic recommendations for key stakeholders.

Latin America’s E-Commerce & Fintech Explosion: Who’s Leading and Why It Matters

Latin America’s E-Commerce & Fintech Explosion: Who’s Leading and Why It Matters

E-commerce and digital finance are revolutionizing South America’s economy, creating new powerhouses and investment magnets across the region.

-

MercadoLibre, often dubbed “Latin America’s Amazon,” smashed expectations: Q1 net profit surged 44%, revenue jumped 37%, with Mercado Pago driving payment and credit services growth.

- Fintech boom continues: Revolut acquired Cetelem Argentina (BNP Paribas) to access cross-border banking. Ualá, Clip, and Mercado Pago also compete in this high-growth space.

Digital payments are mainstream:

- Brazil’s Pix handles ~40% of online transactions, used by 75% of adults.

- Regional fintech market reached $889b in 2023 with a 39.4% CAGR forecast through 2032.

AgTech & AgFintech in South America: How Innovation is Transforming Farming

Agriculture remains the backbone of South America, but agtech and agfintech are redefining how it works.

- Brazil leads in soy, coffee, beef; Colombia in avocado, cocoa, and sugarcane.

- Small farmers face credit challenges. Agfintech solutions include:

-

Traive: Uses AI to assess farm credit risk; raised US$20M from Banco do Brasil.

-

Solinftec: Robotics + AI agtech firm backed by TPG and Bloomberg-linked investors.

-

Traive: Uses AI to assess farm credit risk; raised US$20M from Banco do Brasil.

These innovations enhance productivity and promote financial inclusion.

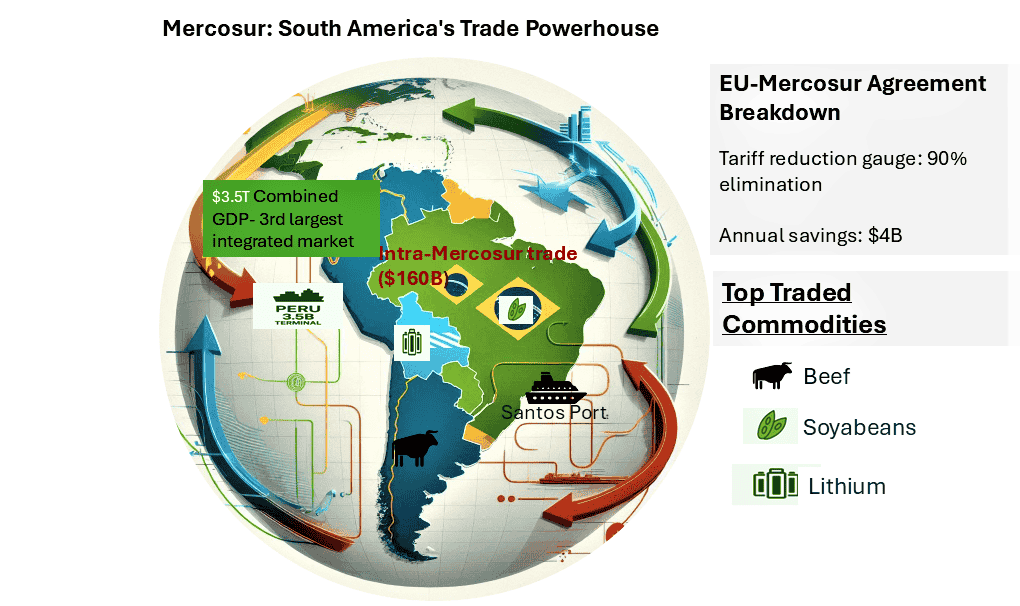

Mercosur Trade and the EU Deal: Unlocking a $4 Billion Opportunity

South America's regional trade networks are strengthening with global momentum, particularly through Mercosur and new international agreements.

- Mercosur: Brazil, Argentina, Paraguay, Uruguay, and Bolivia form the 3rd-largest integrated market ($ 3.5t GDP, $160b intra-bloc trade in 2023).

- EU-Mercosur Agreement: Pending deal to eliminate tariffs on 90% of goods, affecting 780 million people and 25% of global GDP (European Trade Commission).

- China's footprint grows: Investments in Brazil’s Port of Santos and Peru’s $3.5 b deep-water terminal deepen South America’s global integration.

Open Finance in South America: The API Revolution Reshaping Banking

Open banking and API-based finance frameworks are unlocking digital ecosystems and empowering small businesses across Latin America.

- Brazil: Rolled out open finance APIs.

- Chile: Passed fintech and financial portability laws.

- Colombia & Ecuador: Building robust regulatory frameworks.

- Argentina: Launched Transferencias 3.0 (QR-based real-time transfers).

This promotes transparency, competition, and access to finance.

Challenges Slowing Growth in South America’s Markets, and How to Solve Them

Despite the momentum, several roadblocks—from infrastructure to regulation—could slow down progress.

-

Rural infrastructure gaps: Only ~23% of rural Brazil has internet access.

-

Economic volatility: Currency and inflation instability affects trade volumes. Mercosur goods exports fell 4.1% in 2023, though volume rose 3.2%.

-

Regulatory hurdles: Delays in EU-Mercosur ratification and inconsistent fintech regulation across countries.

Risks & Social Impact of South America’s Digital Boom: The Other Side of Growth

As digital innovation accelerates, stakeholders must grapple with inequality, environmental pressure, and structural risks.

Systemic & Market Risks:

- Fragmented regulations and fintech policies.

- Currency volatility across Argentina, Brazil, and Andean nations.

- Climate risks affecting agriculture (droughts, floods).

- Geopolitical influence from the U.S. and China.

Social & Environmental Impact:

- Rural-urban digital divide.

- Labor displacement via agtech automation.

- Informal workforce exclusion from digital finance.

- Environmental degradation tied to mega-infrastructure.

Ethical Imperatives:

- Policymakers must enforce ESG frameworks.

- Investors should adopt sustainability metrics.

- Entrepreneurs must co-create inclusive tech with communities.

South America Market Forecast 2025–2032: Where the Smart Money is Going

Future trends show explosive potential across multiple sectors but long-term winners will prioritize sustainability, scale, and inclusion.

- Fintech: Market projected to hit US$15 t by 2032 (CAGR ~40%).

- AgriTech: AI-powered lending, robotics, and data-led agronomy will redefine farm output and inclusion.

- Trade: EU-Mercosur could unlock US$4 b in annual savings.

-

Global Influence: China’s port and agri-investments reflect deepening ties.

Policy, Investors & Entrepreneurs: Strategies to Win in Latin America’s Growth Wave

To fully unlock South America's potential, each stakeholder group must take targeted, time-bound action.

Policymakers:

- Harmonize digital regulations regionally.

- Build rural digital infrastructure.

- Create ESG-aligned investment incentives.

Entrepreneurs:

- Focus on localization and financial literacy.

- Build solutions for informal and rural economies.

- Co-design products with user communities.

Investors:

- Short-Term (1–2 yrs): Focus on mature fintechs and digital payments (e.g., Pix, Mercado Pago).

- Mid-Term (3–5 yrs): Fund agtech, open finance startups, cross-border e-commerce enablers.

-

Long-Term (6–10 yrs): Bet on infrastructure, regional trade platforms, and ESG-driven ventures.

Bottom Line - Digital transformation in Latin America

South America’s markets are creative and powerful, driven by booming fintech, smart agriculture, integrated trade, and tech-savvy ecosystems. While not without its issues (infrastructure, instability, bureaucracy), the direction is momentum-driven.

With the right blend of innovation, inclusive design, and resilient policy, South America may very well be the world’s next major growth engine.

Senior Editor: Kenneth Njoroge

Financial Expert/Bsc. Commerce/CPA