A representation of Europe’s Economic Crossroads Decline vs. Reinvention

A representation of Europe’s Economic Crossroads Decline vs. Reinvention

Europe 2030: Ai Vs. Aging The €2 Trillion Gamble That Will Make Or Break The Continent

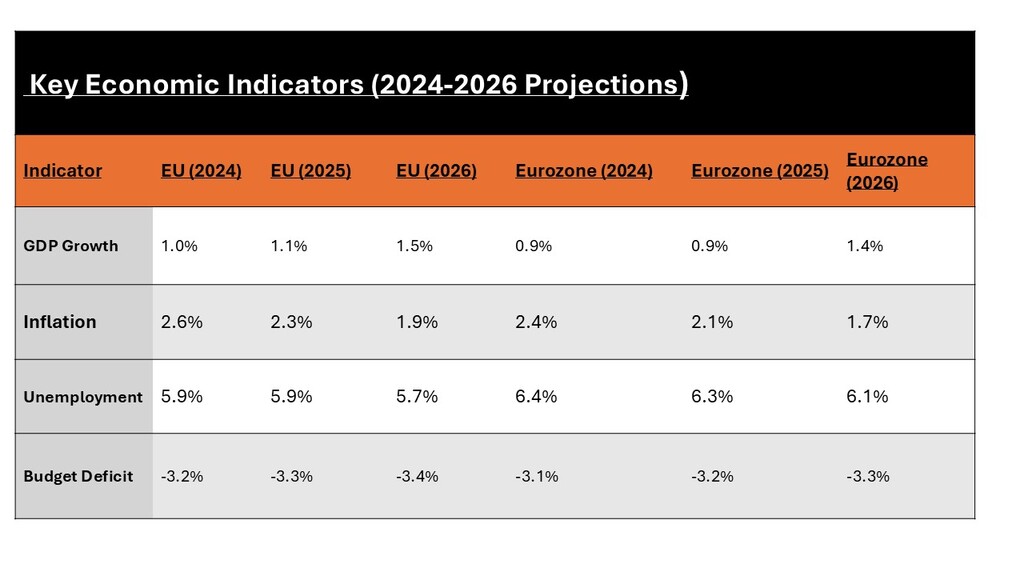

The European economy stands at a critical juncture. While green shoots of recovery emerge from the COVID-19 pandemic and the energy crisis, dark clouds of demographic decline, geopolitical instability, and technological disruption gather on the horizon. The continent that once dominated global commerce now struggles to maintain its footing in an era of American tech supremacy and Asian manufacturing power as pointed out by the macro-economic indicators.

Europe's economic landscape has experienced significant shifts over the past five years, marked by modest growth, evolving policy environments, and structural challenges. In Germany, the once-powerful industrial sector is slowing down, especially as its famous carmakers struggle to shift to electric vehicles. But travel south to Italy, and the picture changes. In the southern region known as the Mezzogiorno, things are picking up, EU recovery funds are driving a surge in construction, and tourism is booming.

As of 2024, some of the leading economies in the region include:

Europe's Sectoral Shifts: Winners and Losers

- Tech & SaaS: Europe added 15 new unicorns in 2024 (e.g., Germany’s DeepL, Sweden’s Klarna), with AI and fintech leading. VC funding hit €24B in H1 2024 (Atomico).

- Clean Tech: Wind and solar investments surged 40% YoY, driven by EU’s Net-Zero Industry Act. Denmark’s Ørsted and Spain’s Iberdrola dominate offshore wind.

- Sustainable Finance: Green bonds issued in EU reached €400B in 2023, with CSRD forcing 50,000+ firms to disclose ESG risks.

2. Declining Industries

- Auto Manufacturing: In April 2025, output fell 8% in Germany (VDA data) as EV transition strains legacy makers. As of May 8, 2025, Stellantis cut 3,500 jobs in Italy.

- Retail Real Estate: Vacancy rates hit 12% in Paris and Berlin (CBRE) in early 2025, with e-commerce now at 30% of retail sales is a projection for 2030.

- Fossil Fuels: Coal power generation dropped to 5% of EU energy mix (from 15% in 2019).

- Digital Markets Act (DMA): Forced Google, Apple, and Meta to open platforms—boosting EU rivals like Spotify and Epic Games.

- AI Act: Strict rules for high-risk AI (e.g., biometrics) take effect in 2026, favoring compliant firms like France’s Mistral AI.

- DORA (Digital Operational Resilience Act): New cybersecurity rules for banks and utilities, with €20M fines for non-compliance.

Geopolitical Risks and Demographic Time Bombs

- Trade Wars: EU tariffs on Chinese EVs (up to 38%) risk retaliation against EU luxury goods and machinery.

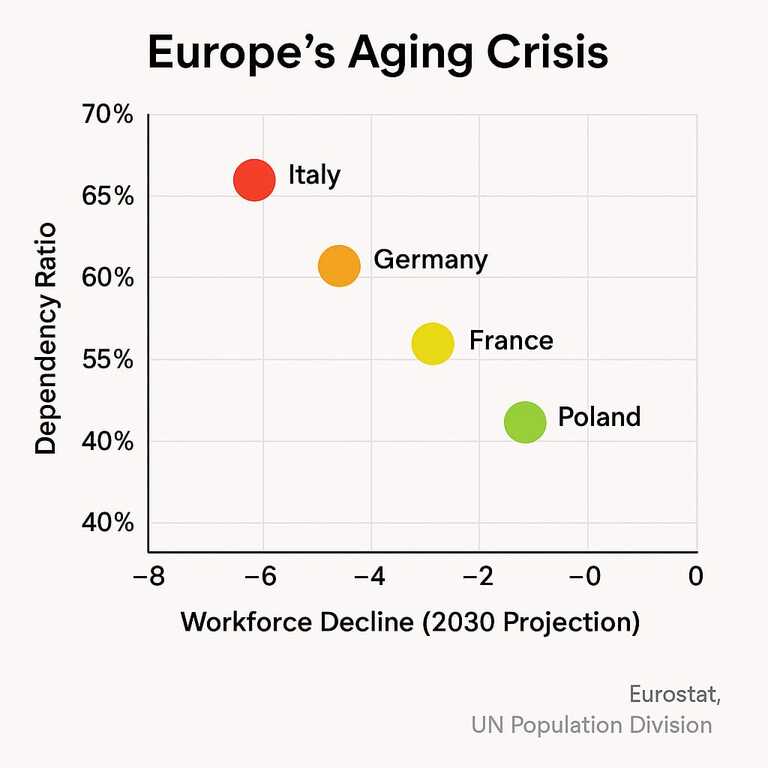

- Aging Workforce: By 2030, 30% of Germany’s population will be over 65—labor shortages could cost €1T/year (Bruegel).

- Debt Dilemma: Italy’s debt-to-GDP (142%) and France’s deficit (4.8%) strain EU fiscal rules.

Europe's Aging population and Workforce Decline in Millions - 2030 Projection

- Double Down on Tech Sovereignty: Scale EU chips (e.g., STMicroelectronics) and AI to reduce US/China reliance.

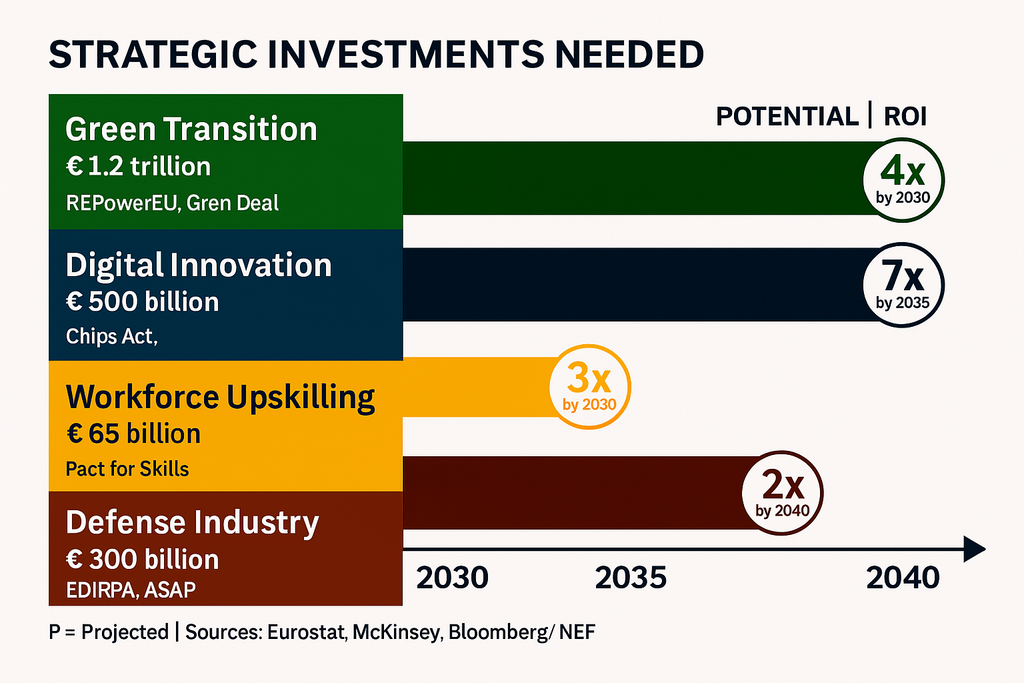

- Fix Labor Gaps: Fast-track visas for skilled migrants; upskill workers for green jobs (EU budgeted €65B for this).

- Reform Fiscal Rules: Relax deficit limits for green/defense spending—critical for Italy and France.

Europe's economy is fighting on multiple fronts, against demographic decline, technological disruption, and geopolitical upheaval. The continent has the tools to reinvent itself, but does it have the political will? The answer will shape global economics for decades to come.