6 min read

Asia Market Outlook 2026: Asia Macro, Equities, Fx & Q1 Scenarios

Asia

Markets

Asia Market Outlook Summary (Q1 2026)

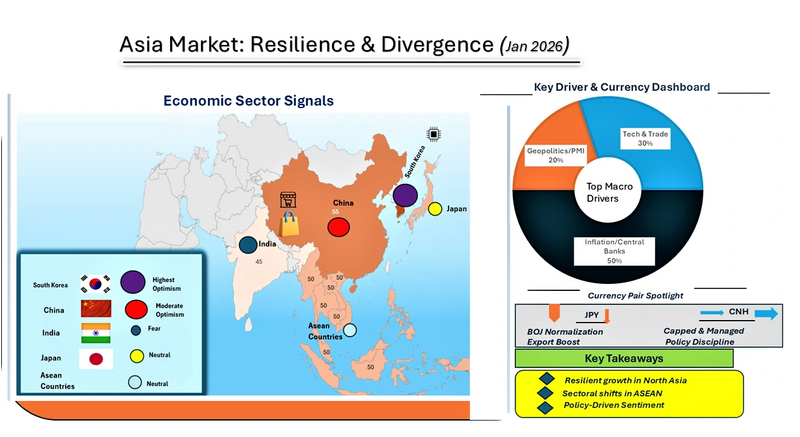

Asia Market Outlook 2026 points to a cautiously risk-on environment in early Q1, supported by easing inflation, resilient exports, and policy-managed stability across China, Japan, and South Korea. This Asia macro outlook highlights selective strength in Asian equities, particularly AI and semiconductor supply chains, alongside contained FX volatility, with the yen softening and the offshore yuan (CNH) capped. Overall, the Asia equity outlook remains constructive but uneven, with performance increasingly driven by policy signals, FX dynamics, and sector-specific fundamentals rather than broad beta.

Asia Macro Outlook

The macro environment leaned cautiously risk-on, supported by easing inflation pressures across East Asia and resilient export flows despite lingering global trade frictions. According to the World Bank’s January 2026 Global Economic Prospects, East Asia and Pacific growth held near 4.8% in 2025, with China at 4.9%, buoyed by fiscal stimulus and consumption resilience. J.P. Morgan’s Asia Outlook 2026 highlighted AI-driven industrial buildouts in China, South Korea, and Taiwan as structural tailwinds for semiconductors and technology.

Asia Equity Market Outlook

Equity markets reflected this resilience: the Nikkei 225 extended gains on domestic demand optimism, while the Shanghai Composite stabilized after property-sector stress. Southeast Asian indices (Vietnam, Indonesia) showed selective strength, benefiting from supply-chain diversification.

Currency markets remained steady, with the CNH capped by cautious capital flows, while the yen softened modestly amid BOJ’s gradual policy normalization. Credit spreads across Asia stayed contained, reflecting confidence in disinflation and policy support.

Currency markets remained steady, with the CNH capped by cautious capital flows, while the yen softened modestly amid BOJ’s gradual policy normalization. Credit spreads across Asia stayed contained, reflecting confidence in disinflation and policy support.

Sector Leadership

-

Technology & semiconductors: Outperformance in Korea and Taiwan on global AI demand

-

Consumer discretionary: Recovery in China, supported by stimulus

-

Financials: Stable, though property-linked exposures weigh on sentiment

-

Defensives: Utilities and staples resilient in Japan and ASEAN markets

Key Drivers Ahead for Asia Market Outlook

China PMI releases, BOJ policy signals, and regional inflation prints will test whether optimism sustains into Q1. Sentiment momentum will remain sensitive to policy communication and FX stability.

Visual Summary: Asian Macro Drivers (Focus Allocation)

- Inflation prints (CPI/PPI): 25%

- Central bank decisions (BOJ, PBOC, RBI): 25%

- PMIs & industrial data: 20%

- Tech/semiconductor earnings: 20%

- Credit spreads/liquidity: 10%

%20(1).png)

Asia macro drivers Jan 2026 pie chart showing inflation, central bank decisions, tech earnings, PMI data, and credit spreads.

Inflation data and central bank policy dominate sentiment formation, while PMIs and tech earnings reflect Asia’s manufacturing resilience and AI-driven growth. Credit conditions remain a stabilizing, secondary factor.

Asia Fear & Greed Index Snapshot

- China: 55

- Japan: 50

- South Korea: 60

- India: 45

- ASEAN (Vietnam, Indonesia): 50

%201%20(1).png)

Asia Fear and Greed Index Jan 2026 bar chart comparing investor sentiment in China, Japan, South Korea, India, and ASEAN.

Optimism is strongest in South Korea on semiconductor momentum, moderate in China, neutral in Japan/ASEAN, and cautious in India due to inflation pressures and capital flow sensitivity.

Asia FX Outlook: Yen and CNH Dynamics

Softened Yen

- Supports Japanese export competitiveness (autos, electronics)

- Raises import costs for energy/raw materials

- Signals BOJ normalization path, tempering regional bond risk appetite

- Increases hedging demand for ASEAN corporates with yen exposure

Capped CNH (Offshore Yuan)

- Reflects managed capital flows and volatility control

- Supports confidence in China’s policy discipline

- Constrains offshore liquidity and arbitrage flows

- Reduces FX volatility for regional trade partners

Trade Implication (Directional, Non‑Prescriptive)

The market environment favors targeted risk-taking rather than broad market exposure. Technology and semiconductor companies in North Asia especially in South Korea and Taiwan, are better positioned to outperform, supported by strong AI investment and resilient exports. Japanese equities also benefit in the near term from a weaker yen, which supports exporters.

By contrast, property-related financials and highly indebted cyclical sectors remain vulnerable. Across the region, the more attractive opportunities are in export-focused manufacturing and AI infrastructure, while a cautious approach to currencies and credit remains appropriate, as gradual policy tightening and managed capital flows are likely to limit sharp upside moves.

The market environment favors targeted risk-taking rather than broad market exposure. Technology and semiconductor companies in North Asia especially in South Korea and Taiwan, are better positioned to outperform, supported by strong AI investment and resilient exports. Japanese equities also benefit in the near term from a weaker yen, which supports exporters.

By contrast, property-related financials and highly indebted cyclical sectors remain vulnerable. Across the region, the more attractive opportunities are in export-focused manufacturing and AI infrastructure, while a cautious approach to currencies and credit remains appropriate, as gradual policy tightening and managed capital flows are likely to limit sharp upside moves.

Asia Market Surprise Risk to Monitor

Asia Market Surprise Risk to Watch

AI Investment Slowdown

If global spending on AI infrastructure slows more than expected due to weaker earnings, tighter regulations, or large tech companies pulling back on investment, it would quickly hurt semiconductor companies in South Korea and Taiwan and their suppliers.

This would weaken the current positive outlook for the sector, likely causing investor sentiment to turn negative, credit conditions in tech to worsen, and money to move back into more defensive and domestically focused sectors.

Asia Market Outlook 2026: Scenario Framework (Next 1–3 Months)

AI Investment Slowdown

If global spending on AI infrastructure slows more than expected due to weaker earnings, tighter regulations, or large tech companies pulling back on investment, it would quickly hurt semiconductor companies in South Korea and Taiwan and their suppliers.

This would weaken the current positive outlook for the sector, likely causing investor sentiment to turn negative, credit conditions in tech to worsen, and money to move back into more defensive and domestically focused sectors.

Asia Market Outlook 2026: Scenario Framework (Next 1–3 Months)

Base Case (est. 60% probability)

Asia’s market outlook remains cautiously positive. Inflation continues to ease and central banks are tightening policy slowly and carefully. In China, government stimulus is helping consumer spending and keeping growth stable without fueling another property boom.

Investment in AI is supporting earnings growth in South Korea and Taiwan, while Japan benefits from a weaker yen without aggressive interest rate hikes from the Bank of Japan. Equity markets are rising gradually in selected areas, credit conditions remain stable, and currency markets are relatively calm.

Asia’s market outlook remains cautiously positive. Inflation continues to ease and central banks are tightening policy slowly and carefully. In China, government stimulus is helping consumer spending and keeping growth stable without fueling another property boom.

Investment in AI is supporting earnings growth in South Korea and Taiwan, while Japan benefits from a weaker yen without aggressive interest rate hikes from the Bank of Japan. Equity markets are rising gradually in selected areas, credit conditions remain stable, and currency markets are relatively calm.

Bull Case (est. 25% probability)

If global demand improves more than expected and policymakers communicate more clearly, investor confidence would rise. Consumer spending in China would strengthen further, manufacturing data across North Asia would improve, and investment in AI would last longer than currently expected.

At the same time, the yen could weaken further without policy surprises, supporting Japanese stocks. Increased capital inflows would lift equity markets across the region and improve credit conditions, allowing Asia to outperform other emerging markets thanks to stronger growth visibility and leadership in technology.

If global demand improves more than expected and policymakers communicate more clearly, investor confidence would rise. Consumer spending in China would strengthen further, manufacturing data across North Asia would improve, and investment in AI would last longer than currently expected.

At the same time, the yen could weaken further without policy surprises, supporting Japanese stocks. Increased capital inflows would lift equity markets across the region and improve credit conditions, allowing Asia to outperform other emerging markets thanks to stronger growth visibility and leadership in technology.

Bear Case (est.15% probability)

If policymakers send mixed signals or an unexpected external shock occurs, investor confidence could quickly weaken. A pullback in AI spending, renewed stress in China’s property sector, or sudden swings in the yen or offshore yuan could push stock markets lower and worsen credit conditions.

In this environment, investors would likely shift money into safer U.S. dollar assets, causing Asian equities to underperform and driving a rotation toward more defensive and domestically focused sectors.

If policymakers send mixed signals or an unexpected external shock occurs, investor confidence could quickly weaken. A pullback in AI spending, renewed stress in China’s property sector, or sudden swings in the yen or offshore yuan could push stock markets lower and worsen credit conditions.

In this environment, investors would likely shift money into safer U.S. dollar assets, causing Asian equities to underperform and driving a rotation toward more defensive and domestically focused sectors.

Key Takeaways: Asia Market Outlook 2026 Q1

-

Resilient Growth Amid Global Frictions. East Asia’s steady GDP growth and China’s stimulus underpin regional stability despite trade tensions.

-

Structural Sector Divergence. AI-driven tech leadership contrasts with property-linked financial fragility.

- Policy-Driven FX and Sentiment . Softened yen and capped CNH anchor currency stability, while sentiment is strongest in South Korea and most cautious in India.

Senior Editor: Kenneth Njoroge

Business & Financial Expert | MBA | Bsc. Commerce | CPA