Us Alteration Of Immigration And Deportation Policies: Complexities On Rushed...

NorthAmerica

Politics

For a long time, the United States has been recognized as a country of law and order, where every individual feels secure and protected. The U.S. has upheld a legal commitment to humanity and human rights. However, in 2025, this narrative shifted due to policies introduced by the Trump administration, transitioning from a sanctuary to a scrutinized space marked by deportation practices and an erosion of humanity.

Executive Orders and the Erosion of Human Rights

The United States has violated its own laws and human rights obligations in an attempt to reclaim its perceived superiority through President Trump's executive orders. During his campaign, President Trump expressed his intention to curb illegal immigration to the U.S. Historically, the U.S. has welcomed immigrants and established legal procedures for migration and citizenship acquisition. Among these avenues, the Diversity Immigrant Visa (DV), introduced in 1990 as part of the Immigration Act, was a gesture of goodwill to accommodate people from diverse nationalities, races, and backgrounds.

A Changing Landscape for Immigrants

The U.S. has long been a favored destination for immigrants due to its diversity, vast opportunities, strong economy, education system, and healthcare. However, recent events have sparked global conversations and instilled fear among immigrants. President Trump has initiated mass deportations of illegal immigrants and enhanced border security to curb unauthorized migration. These changes in immigration and deportation laws have faced criticism for their aggression and legal inconsistencies.

Controversial Deportation Practices

Recent incidents include the revocation of legal status for half a million migrants from Cuba, Haiti, and Venezuela, the deportation of green card holders and international groups with political affiliations, and erroneous deportations. These controversies undermine existing laws and policies, altering them to align with the current administration's interests. For instance, deporting individuals who obtained green cards under the Immigration Act of 1990 conflicts with the government's obligation to uphold its own laws.

Legal and Human Rights Concerns

Deportation practices have come under scrutiny for their conduct, sparking outrage among human rights and civil liberties groups. Deportation has led to complex legal battles due to the lack of a clear framework addressing its repercussions. Many question President Trump's motivations for rushing such a sensitive issue and his regard for humanity and human rights. On April 1st, the New York Times reported on a man who, due to an "administrative error," was deported despite living legally in the U.S. He ended up in a terrorism confinement center. The U.S. had a legal obligation to protect him, but the haste to eliminate immigrants exposed his life to danger.

Discriminatory Practices and Judicial Intervention

Mr. Abrego Garcia, who had sought asylum in the U.S., was protected under the Alien Enemy Act. While the government acknowledged its error, it argued that little could be done after the fact. From a human rights perspective, the issue was not his legality but his nationality. If Abrego had been a U.S. citizen, he would not have faced such exposure. Deportation, therefore, appears to be more of a discriminatory practice aimed at eliminating immigrants. In response to these practices, District Judge Murphy issued a restraining order against the fast-tracking of deportations for individuals from third-world countries, ensuring they have the opportunity to claim persecution or torture. The judge cited the Convention Against Torture as a legal basis for protecting immigrants.

The Need for Balanced Immigration Policies

President Trump's executive orders on systemic detention and deportation have instilled fear among immigrants and their families. The changes in U.S. immigration and deportation policies have sparked critical legal battles and international human rights concerns. While addressing illegal immigration is necessary, the administration must avoid violating human rights. Upholding the sanctity of life should take precedence over all other demands. Before deporting individuals, the administration must evaluate the complexities of each case. As policies continue to evolve, it is imperative to adhere to existing laws and international human rights standards.

Executive Orders and the Erosion of Human Rights

The United States has violated its own laws and human rights obligations in an attempt to reclaim its perceived superiority through President Trump's executive orders. During his campaign, President Trump expressed his intention to curb illegal immigration to the U.S. Historically, the U.S. has welcomed immigrants and established legal procedures for migration and citizenship acquisition. Among these avenues, the Diversity Immigrant Visa (DV), introduced in 1990 as part of the Immigration Act, was a gesture of goodwill to accommodate people from diverse nationalities, races, and backgrounds.

A Changing Landscape for Immigrants

The U.S. has long been a favored destination for immigrants due to its diversity, vast opportunities, strong economy, education system, and healthcare. However, recent events have sparked global conversations and instilled fear among immigrants. President Trump has initiated mass deportations of illegal immigrants and enhanced border security to curb unauthorized migration. These changes in immigration and deportation laws have faced criticism for their aggression and legal inconsistencies.

Controversial Deportation Practices

Recent incidents include the revocation of legal status for half a million migrants from Cuba, Haiti, and Venezuela, the deportation of green card holders and international groups with political affiliations, and erroneous deportations. These controversies undermine existing laws and policies, altering them to align with the current administration's interests. For instance, deporting individuals who obtained green cards under the Immigration Act of 1990 conflicts with the government's obligation to uphold its own laws.

Legal and Human Rights Concerns

Deportation practices have come under scrutiny for their conduct, sparking outrage among human rights and civil liberties groups. Deportation has led to complex legal battles due to the lack of a clear framework addressing its repercussions. Many question President Trump's motivations for rushing such a sensitive issue and his regard for humanity and human rights. On April 1st, the New York Times reported on a man who, due to an "administrative error," was deported despite living legally in the U.S. He ended up in a terrorism confinement center. The U.S. had a legal obligation to protect him, but the haste to eliminate immigrants exposed his life to danger.

Discriminatory Practices and Judicial Intervention

Mr. Abrego Garcia, who had sought asylum in the U.S., was protected under the Alien Enemy Act. While the government acknowledged its error, it argued that little could be done after the fact. From a human rights perspective, the issue was not his legality but his nationality. If Abrego had been a U.S. citizen, he would not have faced such exposure. Deportation, therefore, appears to be more of a discriminatory practice aimed at eliminating immigrants. In response to these practices, District Judge Murphy issued a restraining order against the fast-tracking of deportations for individuals from third-world countries, ensuring they have the opportunity to claim persecution or torture. The judge cited the Convention Against Torture as a legal basis for protecting immigrants.

The Need for Balanced Immigration Policies

President Trump's executive orders on systemic detention and deportation have instilled fear among immigrants and their families. The changes in U.S. immigration and deportation policies have sparked critical legal battles and international human rights concerns. While addressing illegal immigration is necessary, the administration must avoid violating human rights. Upholding the sanctity of life should take precedence over all other demands. Before deporting individuals, the administration must evaluate the complexities of each case. As policies continue to evolve, it is imperative to adhere to existing laws and international human rights standards.

APRIL 11, 2025 AT 7:49 PM

France's Political Climate: Risk, Reward And The New Rules Of...

Europe

Business

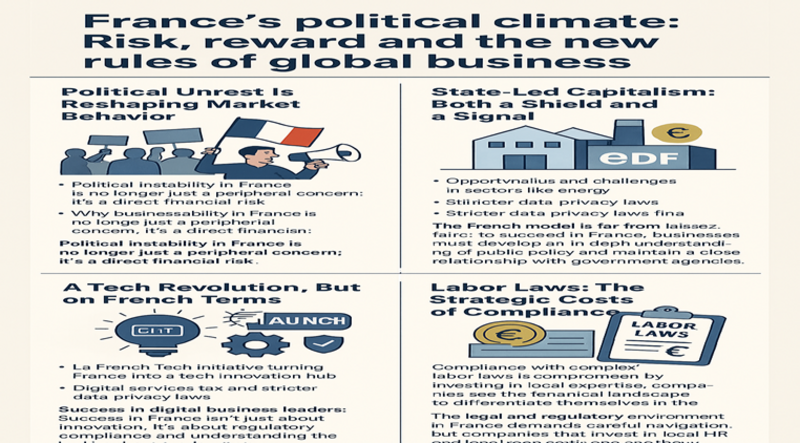

In a world where business leaders must monitor everything from stock charts to shifting political landscapes, understanding the political climate in France has become vital. Often regarded as a bureaucratic maze, France’s unique interplay of government policy, social movements, and economic ambition offers significant opportunities for businesses that can master it. For those adept at operating within France’s political ecosystem, the rewards are substantial.

Protests in 2023: A Wake-Up Call for Businesses

In 2023, France experienced massive protests sparked by President Emmanuel Macron’s pension reform plans. Over a million people took to the streets, causing public transport to grind to a halt, disrupting supply chains, and altering consumer behaviors almost overnight.

Retail giants like Carrefour and hospitality leaders such as Accor Hotels faced severe operational disruptions, with tourism revenue in Paris dropping by an estimated 30% during peak protest weeks. The unrest also led to a temporary contraction in consumer spending and reduced business investment in sectors like retail and hospitality, according to the Paris Tourism Board.

Political instability in France has evolved from being a peripheral concern to a direct financial risk for businesses operating in the country.

State-Influenced Capitalism: Opportunities and Challenges

A defining characteristic of France’s economy is its state-influenced capitalism. In 2023, the government fully renationalized EDF, one of Europe’s largest energy utilities. This move stabilized the energy sector but reinforced the notion that private enterprises must yield when national interests are at stake.

For companies in industries such as aerospace, defense, and energy including Airbus, Thales, and Alstom, this model presents both opportunities and challenges. The French state frequently provides financial backing and regulatory clarity, but businesses must align with government priorities. Foreign companies operating in France must be ready to adapt to these regulations and collaborate with local players to navigate state-driven requirements effectively.

La French Tech: Transforming France into a Tech Hub

In recent years, the La French Tech initiative has turned France into a major hub for tech innovation, with Paris emerging as a strong competitor to cities like London and Berlin for fintech and AI startups. Today, France boasts over 30 tech unicorns, fueled by:

Protests in 2023: A Wake-Up Call for Businesses

In 2023, France experienced massive protests sparked by President Emmanuel Macron’s pension reform plans. Over a million people took to the streets, causing public transport to grind to a halt, disrupting supply chains, and altering consumer behaviors almost overnight.

Retail giants like Carrefour and hospitality leaders such as Accor Hotels faced severe operational disruptions, with tourism revenue in Paris dropping by an estimated 30% during peak protest weeks. The unrest also led to a temporary contraction in consumer spending and reduced business investment in sectors like retail and hospitality, according to the Paris Tourism Board.

Political instability in France has evolved from being a peripheral concern to a direct financial risk for businesses operating in the country.

State-Influenced Capitalism: Opportunities and Challenges

A defining characteristic of France’s economy is its state-influenced capitalism. In 2023, the government fully renationalized EDF, one of Europe’s largest energy utilities. This move stabilized the energy sector but reinforced the notion that private enterprises must yield when national interests are at stake.

For companies in industries such as aerospace, defense, and energy including Airbus, Thales, and Alstom, this model presents both opportunities and challenges. The French state frequently provides financial backing and regulatory clarity, but businesses must align with government priorities. Foreign companies operating in France must be ready to adapt to these regulations and collaborate with local players to navigate state-driven requirements effectively.

La French Tech: Transforming France into a Tech Hub

In recent years, the La French Tech initiative has turned France into a major hub for tech innovation, with Paris emerging as a strong competitor to cities like London and Berlin for fintech and AI startups. Today, France boasts over 30 tech unicorns, fueled by:

- Tax incentives

- Public-private partnerships

- Targeted funding

However, France has also asserted its regulatory power over global tech giants. The introduction of the Digital Services Tax (DST), a 3% levy on revenues from large digital firms, specifically targeted U.S. companies like Google and Amazon. This policy challenges non-European players entering the French market while favoring local firms.

Additionally, France’s strict data privacy laws, often exceeding the EU baseline, require businesses to adapt their operations to meet heightened standards.

Labor Protections: Turning Challenges into Advantages

France is renowned for its robust employee protections. While the Macron ordinances of 2017 streamlined parts of labor law, compliance remains complex and costly. A 2022 survey by the American Chamber of Commerce in France found that 42% of U.S. firms consider labor rigidity their greatest operational challenge. However, the same survey revealed growing satisfaction with France’s tax reforms and vibrant tech sector.

Global firms like Amazon have turned labor challenges into competitive advantages by investing in local expertise. By assembling strong legal teams and collaborating with labor unions, companies have successfully navigated complex regulations, transforming compliance into operational efficiency and market differentiation.

Unlocking France’s Advantages: A Strategic Approach

For global business leaders, France provides unparalleled access to:

- The European Union market

- A highly skilled workforce

- A thriving innovation ecosystem

To harness these advantages, companies must go beyond standard risk analysis. Understanding French legislation, recognizing the impact of social movements, and adapting to the state-business dynamic are essential for success.

Conclusion: Navigating Complexity for Strategic Edge

While France’s political and regulatory environment poses challenges, it also offers unique opportunities for businesses willing to embrace its complexity. For those ready to engage with its legislation, partner with local players, and adapt to shifting dynamics, France delivers not only hurdles but a strategic edge in the European market.

Conclusion: Navigating Complexity for Strategic Edge

While France’s political and regulatory environment poses challenges, it also offers unique opportunities for businesses willing to embrace its complexity. For those ready to engage with its legislation, partner with local players, and adapt to shifting dynamics, France delivers not only hurdles but a strategic edge in the European market.

APRIL 9, 2025 AT 5:22 PM

A Blessing Or A Business Disruptor? The Role Of Foreign...

NorthAmerica

Politics

Foreign aid has long been a crucial lifeline for Haiti, one of the poorest nations in the Western Hemisphere. From humanitarian relief following devastating natural disasters to development assistance aimed at improving infrastructure and healthcare, aid has poured into the country for decades. However, as much as foreign aid has provided essential support, it has also raised critical questions about its long-term impact on Haiti’s economy. Is foreign aid a blessing, lifting Haiti’s people out of poverty, or does it act as a business disruptor, stifling local enterprise and self-sufficiency?

The Lifesaving Impact of Foreign Aid

Proponents of foreign aid argue that it has been lifesaving for Haiti. Following the catastrophic 2010 earthquake, foreign governments, NGOs, and international organizations pledged over $13 billion in aid (World Bank, 2011). This support helped rebuild schools, hospitals, roads, and homes, providing immediate relief to millions left homeless and destitute. One clear example of aid’s positive impact is the Partners In Health (PIH) initiative in Haiti. With funding from international donors, PIH built the Mirebalais University Hospital, the largest solar-powered hospital in the Caribbean. This hospital delivers world-class healthcare services to Haitians and trains local doctors and nurses, strengthening the country’s healthcare system (Partners In Health, 2013).

Foreign Aid’s Role in Education and Employment Opportunities

Foreign aid has played a significant role in education. Programs like USAID’s “Room to Learn” have provided thousands of Haitian children with access to basic education, school supplies, and nutritious meals (USAID, 2016). These investments aim to break the cycle of poverty by giving future generations better opportunities. Aid-funded programs also create employment opportunities, as infrastructure construction and social services often rely heavily on local workers, injecting much-needed income into communities and fostering job stability.

Economic Interference Through Resource Extraction

However, foreign aid has not been without its downsides. Beyond the visible market disruptions, aid has also facilitated covert forms of economic interference, particularly in Haiti’s natural resource sector. In the aftermath of the 2010 earthquake, while humanitarian aid focused on rebuilding efforts, several foreign mining companies, mainly Canadian and American, quietly obtained permits to explore and extract Haiti’s untapped gold, copper, and silver reserves. Haiti’s weakened institutions, heavily reliant on external assistance, lacked the capacity to negotiate favorable terms. Many agreements were brokered without transparent consultation with affected communities, raising concerns about environmental degradation, unfair revenue distribution, and lack of local benefit. This form of resource extraction echoes neocolonial practices, where foreign entities profit under the guise of development assistance.

Challenges of Mismanagement and Dependency

Foreign aid has often been marred by mismanagement and lack of accountability. A 2015 investigation by NPR and ProPublica revealed that despite raising over $500 million for post-earthquake housing, the American Red Cross managed to build only six permanent homes. Such inefficiencies highlight systemic flaws in the aid system and erode public trust. The emphasis on short-term relief frequently overshadows long-term development. Rather than investing in sustainable projects like renewable energy, local entrepreneurship, or institutional strengthening, many aid programs focus on immediate fixes, leaving Haiti trapped in a cycle of dependency and underdevelopment.

Transforming Foreign Aid for Sustainable Development

The solution lies not in eliminating foreign aid but in transforming its approach. Moving toward partnership-based strategies is key. For instance, successful microfinance institutions like Fonkoze, Haiti’s largest microfinance provider, use donor funds to offer small loans and training to Haitian entrepreneurs, particularly women. This empowers locals to build sustainable businesses and reduces dependency. Furthermore, collaboration between aid agencies and local industries ensures that aid complements, rather than competes with, domestic production.

A Balanced Approach to Foreign Aid

Foreign aid can be both a blessing and a business disruptor. The challenge is to balance immediate humanitarian needs with long-term economic empowerment. Only by aligning aid efforts with local business growth, institutional strengthening, and resource sovereignty can Haiti truly transition from dependence to development.

The Lifesaving Impact of Foreign Aid

Proponents of foreign aid argue that it has been lifesaving for Haiti. Following the catastrophic 2010 earthquake, foreign governments, NGOs, and international organizations pledged over $13 billion in aid (World Bank, 2011). This support helped rebuild schools, hospitals, roads, and homes, providing immediate relief to millions left homeless and destitute. One clear example of aid’s positive impact is the Partners In Health (PIH) initiative in Haiti. With funding from international donors, PIH built the Mirebalais University Hospital, the largest solar-powered hospital in the Caribbean. This hospital delivers world-class healthcare services to Haitians and trains local doctors and nurses, strengthening the country’s healthcare system (Partners In Health, 2013).

Foreign Aid’s Role in Education and Employment Opportunities

Foreign aid has played a significant role in education. Programs like USAID’s “Room to Learn” have provided thousands of Haitian children with access to basic education, school supplies, and nutritious meals (USAID, 2016). These investments aim to break the cycle of poverty by giving future generations better opportunities. Aid-funded programs also create employment opportunities, as infrastructure construction and social services often rely heavily on local workers, injecting much-needed income into communities and fostering job stability.

Economic Interference Through Resource Extraction

However, foreign aid has not been without its downsides. Beyond the visible market disruptions, aid has also facilitated covert forms of economic interference, particularly in Haiti’s natural resource sector. In the aftermath of the 2010 earthquake, while humanitarian aid focused on rebuilding efforts, several foreign mining companies, mainly Canadian and American, quietly obtained permits to explore and extract Haiti’s untapped gold, copper, and silver reserves. Haiti’s weakened institutions, heavily reliant on external assistance, lacked the capacity to negotiate favorable terms. Many agreements were brokered without transparent consultation with affected communities, raising concerns about environmental degradation, unfair revenue distribution, and lack of local benefit. This form of resource extraction echoes neocolonial practices, where foreign entities profit under the guise of development assistance.

Challenges of Mismanagement and Dependency

Foreign aid has often been marred by mismanagement and lack of accountability. A 2015 investigation by NPR and ProPublica revealed that despite raising over $500 million for post-earthquake housing, the American Red Cross managed to build only six permanent homes. Such inefficiencies highlight systemic flaws in the aid system and erode public trust. The emphasis on short-term relief frequently overshadows long-term development. Rather than investing in sustainable projects like renewable energy, local entrepreneurship, or institutional strengthening, many aid programs focus on immediate fixes, leaving Haiti trapped in a cycle of dependency and underdevelopment.

Transforming Foreign Aid for Sustainable Development

The solution lies not in eliminating foreign aid but in transforming its approach. Moving toward partnership-based strategies is key. For instance, successful microfinance institutions like Fonkoze, Haiti’s largest microfinance provider, use donor funds to offer small loans and training to Haitian entrepreneurs, particularly women. This empowers locals to build sustainable businesses and reduces dependency. Furthermore, collaboration between aid agencies and local industries ensures that aid complements, rather than competes with, domestic production.

A Balanced Approach to Foreign Aid

Foreign aid can be both a blessing and a business disruptor. The challenge is to balance immediate humanitarian needs with long-term economic empowerment. Only by aligning aid efforts with local business growth, institutional strengthening, and resource sovereignty can Haiti truly transition from dependence to development.

APRIL 9, 2025 AT 4:35 PM

Nigeria At A Crossroads: Can Business And Politics Deliver A...

Africa

Innovation

Nigeria, often dubbed the “Giant of Africa,” stands at a pivotal crossroads. As Africa’s largest economy and home to one of the youngest populations globally, the country brims with potential. Yet, unlocking this promise requires addressing a long-standing challenge: the complex and often uneasy relationship between business and politics. Today, a new and urgent dimension adds further complexity in sustainability.

Politics and Business: A Tightly Woven Relationship

In Nigeria, politics and business have historically been inseparable. From the oil boom of the 1970s to the current tech-driven renaissance, government policies, political stability, and state interventions have consistently shaped market dynamics.

While stable periods have nurtured economic growth, challenges such as corruption, regulatory inconsistency, and political instability have frequently stifled innovation and discouraged investment. However, there are glimpses of progress. The country has made strides in democratic governance, marked by peaceful transitions of power, the rise of young political voices, and civic tech platforms demanding accountability. These developments signal a gradual shift toward transparent and responsive leadership.

Environmental Challenges: A Nation at Risk

If Nigeria is to fully realize its potential, sustainability must enter the national agenda. The country faces pressing environmental threats:

Politics and Business: A Tightly Woven Relationship

In Nigeria, politics and business have historically been inseparable. From the oil boom of the 1970s to the current tech-driven renaissance, government policies, political stability, and state interventions have consistently shaped market dynamics.

While stable periods have nurtured economic growth, challenges such as corruption, regulatory inconsistency, and political instability have frequently stifled innovation and discouraged investment. However, there are glimpses of progress. The country has made strides in democratic governance, marked by peaceful transitions of power, the rise of young political voices, and civic tech platforms demanding accountability. These developments signal a gradual shift toward transparent and responsive leadership.

Environmental Challenges: A Nation at Risk

If Nigeria is to fully realize its potential, sustainability must enter the national agenda. The country faces pressing environmental threats:

- Desertification: Advancing across the north, jeopardizing livelihoods.

- Floods: Ravaging the south and displacing millions, including over 2.4 million people in the 2022 floods.

- Deforestation: Loss of approximately 350,000 hectares of forest annually.

- Pollution: Oil-induced environmental degradation continues to harm communities in the Niger Delta.

These crises underscore the need for urgent action. Within these challenges lies an opportunity—the potential rise of a green economy.

The Rise of a Green Economy: Opportunities Abound

Sustainability could reshape Nigeria’s economic future, with significant potential in sectors such as:

- Renewable energy: Nigeria boasts one of the world’s highest solar potentials, with solar irradiation averaging 5.5 kWh/m²/day. Despite this, around 85 million Nigerians (43% of the population) lack access to electricity. Companies like Lumos and Arnergy are meeting this challenge by expanding solar home systems, while the Nigeria Electrification Project deploys mini grids to underserved areas.

- Climate-smart agriculture: A vital sector, as agriculture employs about 35% of Nigeria’s workforce.

- Eco-friendly manufacturing and responsible mining: These industries could drive sustainable economic growth.

- Investors are taking notice. Green-focused initiatives are beginning to attract funding from development partners and private financiers. However, these efforts remain fragmented and underpowered without decisive political will, regulatory frameworks, and long-term incentives.

Policy Progress and Challenges

Nigeria has made encouraging policy moves, such as: Climate Change Act (2021): Mandates carbon budgeting and outlines pathways for sustainable development.

Net-zero pledge by 2060: Demonstrates commitment to combating climate change.

Yet, these ambitious targets alone are insufficient. Corruption, entrenched interests, and bureaucratic inefficiencies continue to slow progress. The nation needs not just policies but bold political courage. Leaders must prioritize environmental protection, foster green innovation, and integrate sustainability into economic planning. Only then can Nigeria diversify beyond oil, create jobs, and raise living standards while safeguarding its environment.

The Call for Sustainable Practices

Sustainability is no longer optional for Nigeria, it is essential. As climate risks escalate, the stakes are clear: adapt or face dire consequences. Businesses, policymakers, and civil society must forge a new social contract that balances economic growth with environmental preservation and social equity.

Nigeria possesses the talent, entrepreneurial drive, and natural resources to lead Africa’s green revolution. The question is no longer if this transformation will happen, but when and how quickly. Success will depend on the strength of its politics, the vision of its business leaders, and the determination of its people.

APRIL 9, 2025 AT 10:25 AM

Samarkand Summit: Eu And Central Asia Forge Strategic Partnership Amid...

Asia

Politics

In a groundbreaking move that highlights the increasing global importance of Central Asia, the European Union and the Central Asian nations have elevated their bilateral relationship to a strategic partnership. This development emerged from the first-ever EU-Central Asia Summit, held on April 4, 2025, in Samarkand, Uzbekistan. Leaders from the EU and the five Central Asian republics: Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan, came together to forge a new path of cooperation.

A Critical Moment in Global Politics

The summit took place amid a shifting global landscape, marked by alliances in flux, economic recovery following Covid-19, and the continuing Russia-Ukraine conflict. Central Asia’s strategic value, both economically and geopolitically, has driven the EU to deepen engagement in the region. This partnership also reflects Europe’s response to the growing influence of China and Russia in Central Asia.

Central Asia’s Geopolitical Importance

Home to vast natural resources like oil, gas, and rare earth minerals, Central Asia holds a pivotal role in global trade. Its location at the crossroads of Asia, Russia, and Europe gives the region added significance, especially as initiatives like the Middle Corridor, a trade route connecting Europe to Asia while bypassing Russia, gain prominence.

The Samarkand Declaration: Defining Areas of Cooperation

The Samarkand Summit produced the Samarkand Declaration, a blueprint for the new strategic relationship between the EU and Central Asia. Key areas of focus include:

A Critical Moment in Global Politics

The summit took place amid a shifting global landscape, marked by alliances in flux, economic recovery following Covid-19, and the continuing Russia-Ukraine conflict. Central Asia’s strategic value, both economically and geopolitically, has driven the EU to deepen engagement in the region. This partnership also reflects Europe’s response to the growing influence of China and Russia in Central Asia.

Central Asia’s Geopolitical Importance

Home to vast natural resources like oil, gas, and rare earth minerals, Central Asia holds a pivotal role in global trade. Its location at the crossroads of Asia, Russia, and Europe gives the region added significance, especially as initiatives like the Middle Corridor, a trade route connecting Europe to Asia while bypassing Russia, gain prominence.

The Samarkand Declaration: Defining Areas of Cooperation

The Samarkand Summit produced the Samarkand Declaration, a blueprint for the new strategic relationship between the EU and Central Asia. Key areas of focus include:

- Economic Integration Central Asia’s resource wealth is a major draw for the EU. The partnership aims to boost trade through reduced tariffs, streamlined customs, and improved logistical links, including across the Caspian Sea and the Middle Corridor. By mid-2026, the launch of a Central Asia–EU Trade and Investment Platform will prioritize renewable energy, agriculture, and high-tech manufacturing.

- Regional Security Addressing instability from neighboring Afghanistan and extremism, the EU has committed to intelligence sharing, counter-terrorism efforts, and bolstering border security. The formation of an EU-Central Asia Security Dialogue will help tackle shared security challenges.

- Climate Action and Sustainability With pressing environmental issues like water scarcity and desertification, the partnership will prioritize green energy, water management, ecological restoration, and carbon reduction to promote sustainable development.

- Governance and Human Rights Recognizing the need for governance reforms, the EU will support efforts to strengthen democratic institutions, legal frameworks, and civil liberties within Central Asia.

An Alternative to Chinese and Russian Influence

By emphasizing democratic values, multilateral cooperation, and good governance, the EU positions itself as a counterbalance to authoritarian models advanced by China and Russia. The partnership offers Central Asia a sustainable, inclusive growth path that aligns with European values.

A Shift from Confrontation to Collaboration

The EU-Central Asia Strategic Partnership represents a step toward collaboration in a region of growing global importance. Central Asia's natural resources, expanding markets, and crucial trade routes place it at the heart of Europe’s economic and security strategies.

A Transformative Chapter

The Samarkand Summit marks a new phase in regional relations. However, the success of this strategic partnership will depend on how effectively both sides implement the initiatives outlined in the Samarkand Declaration. For the EU and Central Asia, this collaboration holds the promise of interconnected growth, shared prosperity, and greater stability.

APRIL 8, 2025 AT 1:40 PM

U.S Tariffs Shake Global Trade: Retaliatory Tariffs By China, European...

NorthAmerica

Business

In a sweeping shift that has sent tremors through global markets and reignited geopolitical tensions, the United States has rolled out a series of aggressive tariffs on imported goods. Marking one of the most significant reversals of free trade policy in decades, the move has disrupted diplomatic relations and raised questions about the future of globalization, international trade governance, and the U.S.'s role in the global economy.

The White House’s Justification: Correcting Trade Imbalances

The White House views the tariffs as part of a broader effort to correct chronic trade imbalances and revive manufacturing jobs lost to decades of outsourcing. Officials argue that past trade deals have disproportionately favored foreign producers at the expense of American industry, asserting that the U.S. can no longer afford to subsidize and support other economies while hollowing out its own.

Critics Warn of Political Motives and Economic Risks

However, critics contend that the tariffs are politically motivated, designed to energize domestic constituencies ahead of the 2026 midterm elections. While short-term gains may seem favorable, long-term risks, including higher prices, supply chain disruptions, and retaliatory tariffs, could weigh heavily on the U.S. economy.

Global Retaliation: China and the EU Respond

China's Swift Countermeasures

The White House’s Justification: Correcting Trade Imbalances

The White House views the tariffs as part of a broader effort to correct chronic trade imbalances and revive manufacturing jobs lost to decades of outsourcing. Officials argue that past trade deals have disproportionately favored foreign producers at the expense of American industry, asserting that the U.S. can no longer afford to subsidize and support other economies while hollowing out its own.

Critics Warn of Political Motives and Economic Risks

However, critics contend that the tariffs are politically motivated, designed to energize domestic constituencies ahead of the 2026 midterm elections. While short-term gains may seem favorable, long-term risks, including higher prices, supply chain disruptions, and retaliatory tariffs, could weigh heavily on the U.S. economy.

Global Retaliation: China and the EU Respond

China's Swift Countermeasures

China, which exported over $500 billion worth of goods to the U.S. in 2024, retaliated quickly by announcing a 34% blanket tariff on all American imports, effective April 10. Beijing has also threatened to restrict exports of rare earth minerals, critical to U.S. defense, electronics, and energy sectors, and has filed a formal complaint with the World Trade Organization (WTO), accusing the U.S. of violating key trade agreements.

The European Union’s Response

The European Union’s Response

Meanwhile, the European Union is preparing its own countermeasures. European Commission President Ursula condemned the U.S. tariffs as economically shortsighted and politically regressive. The EU is drafting a list of retaliatory tariffs targeting U.S. agricultural goods, aircraft parts, and tech products, with potential impacts exceeding £26 billion.

In a sign of growing diplomatic realignment, China and the EU are reportedly exploring new trade mechanisms to bypass U.S. dominance, signaling a potential redrawing of global trade alliances.

Financial Markets in Turmoil

The financial markets have reacted with notable volatility. Wall Street experienced a $2.5 trillion wipeout within days of the tariff announcement, with the S&P 500 and Nasdaq posting their sharpest single-day drops since 2020. This volatility could signal the beginning of a broader market correction, particularly for sectors reliant on imports and global supply chains, such as technology, retail, and auto manufacturing.

Rising Consumer Prices and Industry Fallout

At the consumer level, prices are expected to rise significantly. Retailers have already warned of impending markups on a wide range of goods, from electronics to household essentials. U.S. farmers, heavily reliant on exports to China and Europe, are bracing for losses as foreign markets impose restrictions on American soybeans, pork, and corn.

Stagflation Fears Loom

The tariffs have also sparked fears of stagflation, a dangerous combination of rising inflation and slowing economic growth. With interest rates still elevated to combat previous inflationary pressures, the Federal Reserve now faces a precarious balancing act in managing monetary policy.

A New Geopolitical Reality

Beyond economics, the tariffs represent a deeper geopolitical shift. As the U.S. seeks to decouple from global supply chains and assert trade independence, other nations are reevaluating their reliance on American markets. The emerging trend points toward the formation of economic blocs, one led by China and the other by the U.S., each backed by regional partners and new trade agreements.

This fracturing of global trade dynamics risks reducing economic efficiency, fueling inflation, and escalating economic conflicts into broader political disputes.

The WTO’s Diminished Role

The World Trade Organization now faces a crisis of relevance, as major powers increasingly bypass or challenge its authority. While some analysts argue that the U.S. could be using tariffs as leverage to renegotiate better trade deals, ongoing retaliation could plunge the global economy into a prolonged slowdown.

A Fractured Future for Global Trade

As the dust settles, one thing is clear: global trade is entering a more fractured and contentious era. Protectionism is no longer a fringe policy but a mainstream approach in several of the world's largest economies. Whether this shift results in resilience or regression will depend on how governments and businesses navigate the complex challenges ahead.

In a sign of growing diplomatic realignment, China and the EU are reportedly exploring new trade mechanisms to bypass U.S. dominance, signaling a potential redrawing of global trade alliances.

Financial Markets in Turmoil

The financial markets have reacted with notable volatility. Wall Street experienced a $2.5 trillion wipeout within days of the tariff announcement, with the S&P 500 and Nasdaq posting their sharpest single-day drops since 2020. This volatility could signal the beginning of a broader market correction, particularly for sectors reliant on imports and global supply chains, such as technology, retail, and auto manufacturing.

Rising Consumer Prices and Industry Fallout

At the consumer level, prices are expected to rise significantly. Retailers have already warned of impending markups on a wide range of goods, from electronics to household essentials. U.S. farmers, heavily reliant on exports to China and Europe, are bracing for losses as foreign markets impose restrictions on American soybeans, pork, and corn.

Stagflation Fears Loom

The tariffs have also sparked fears of stagflation, a dangerous combination of rising inflation and slowing economic growth. With interest rates still elevated to combat previous inflationary pressures, the Federal Reserve now faces a precarious balancing act in managing monetary policy.

A New Geopolitical Reality

Beyond economics, the tariffs represent a deeper geopolitical shift. As the U.S. seeks to decouple from global supply chains and assert trade independence, other nations are reevaluating their reliance on American markets. The emerging trend points toward the formation of economic blocs, one led by China and the other by the U.S., each backed by regional partners and new trade agreements.

This fracturing of global trade dynamics risks reducing economic efficiency, fueling inflation, and escalating economic conflicts into broader political disputes.

The WTO’s Diminished Role

The World Trade Organization now faces a crisis of relevance, as major powers increasingly bypass or challenge its authority. While some analysts argue that the U.S. could be using tariffs as leverage to renegotiate better trade deals, ongoing retaliation could plunge the global economy into a prolonged slowdown.

A Fractured Future for Global Trade

As the dust settles, one thing is clear: global trade is entering a more fractured and contentious era. Protectionism is no longer a fringe policy but a mainstream approach in several of the world's largest economies. Whether this shift results in resilience or regression will depend on how governments and businesses navigate the complex challenges ahead.

APRIL 7, 2025 AT 11:40 AM